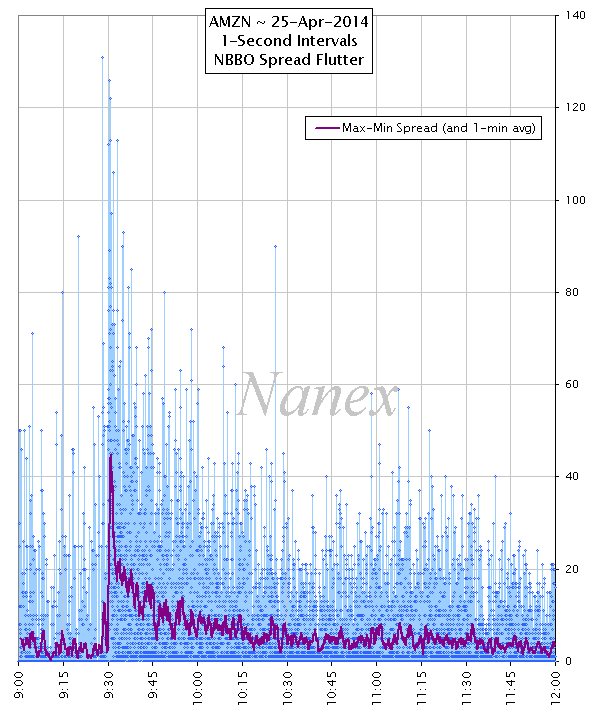

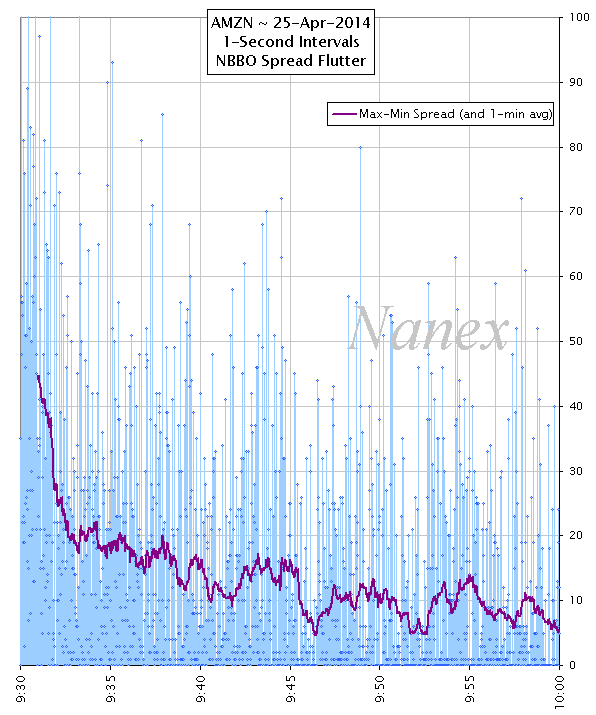

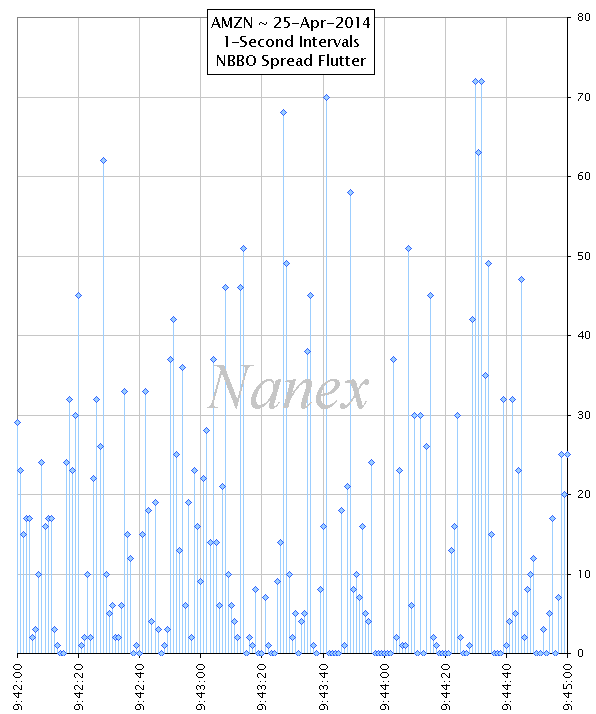

Each blue dot shows how much the NBBO spread varied within 1 second of time. This is not a measurement of how wide or tight spreads are, but rather an indication of NBBO stability. A stock with a constant 10 cent spread would plot out as a flat line at zero. This chart shows that the NBBO in Amazon often varied 20 cents or more EACH SECOND, with some seconds exceeding $1.00.

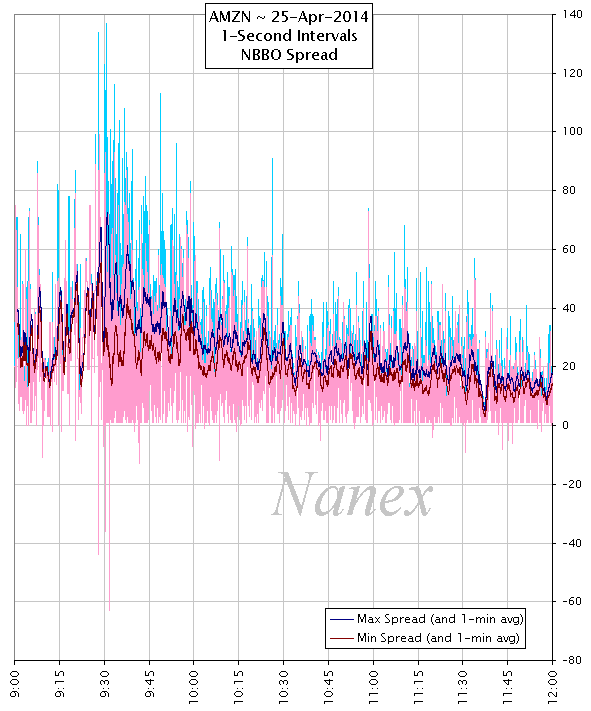

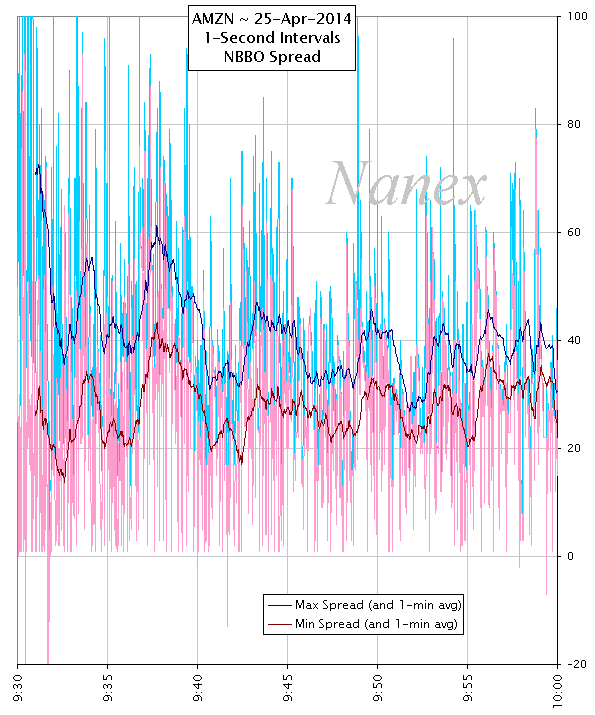

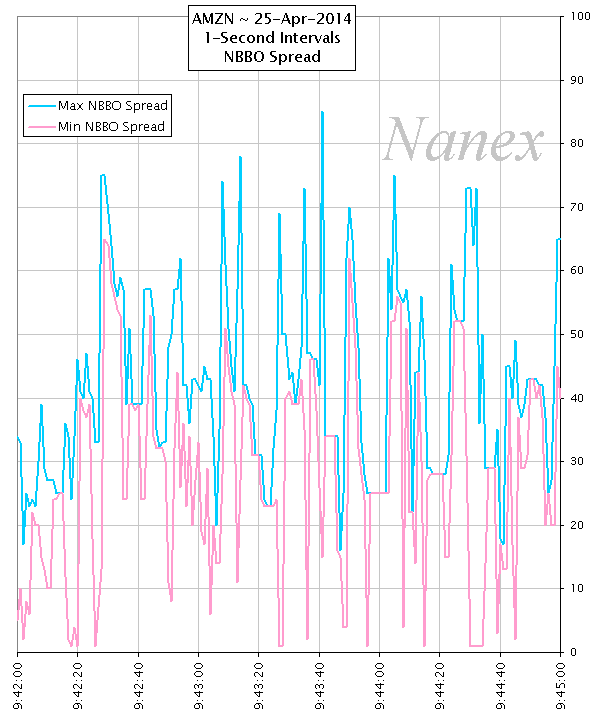

There shouldn't be values at zero (which would indicate a locked market) or negative (which indicates a crossed market).