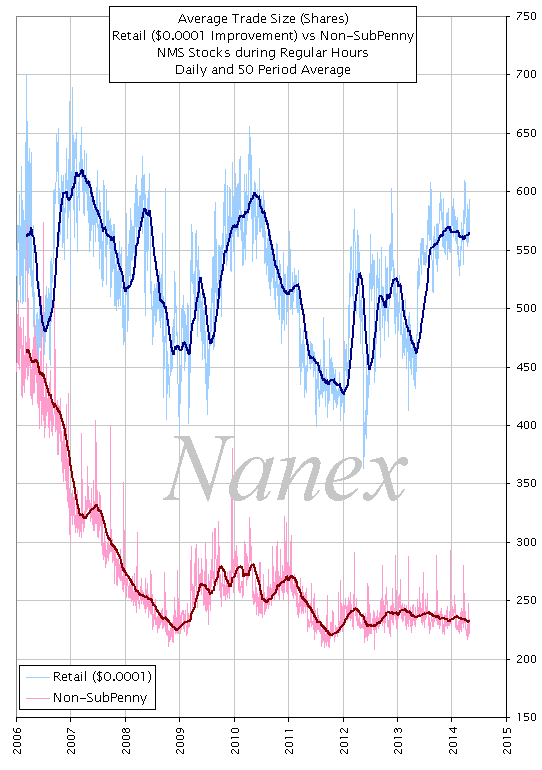

The average size of a retail trade has been fairly constant - currently it's about 560 shares per trade.

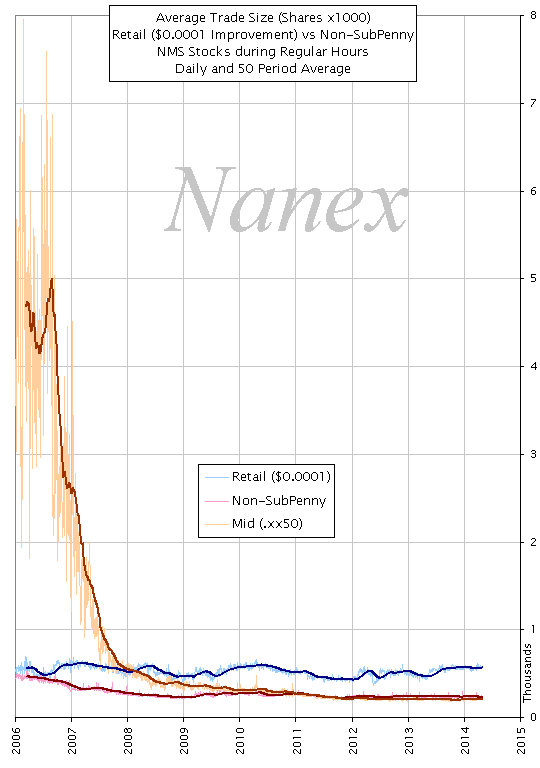

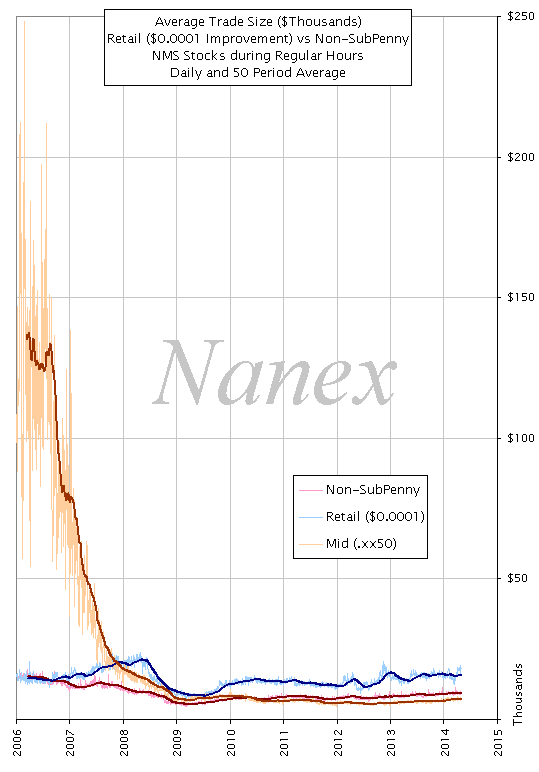

Note the dramatic drop in the size of midpoint price trades (right chart, brown) - from a high of 8,000 shares per trade to about 200 shares per trade today.

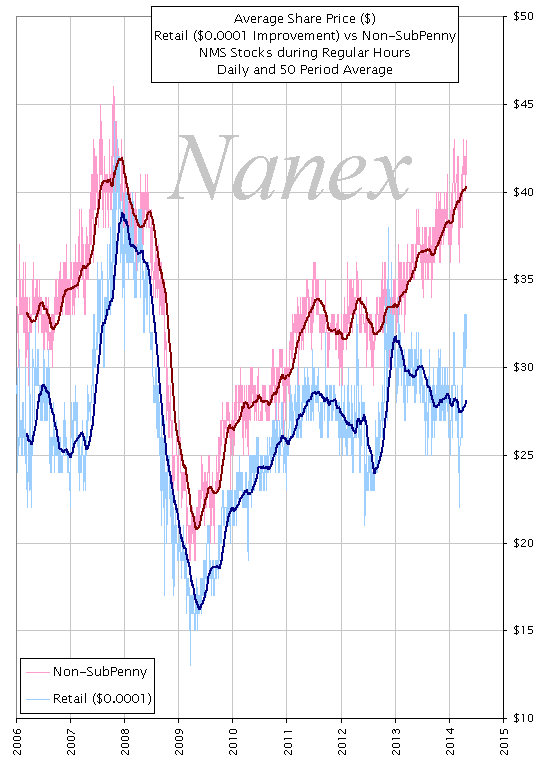

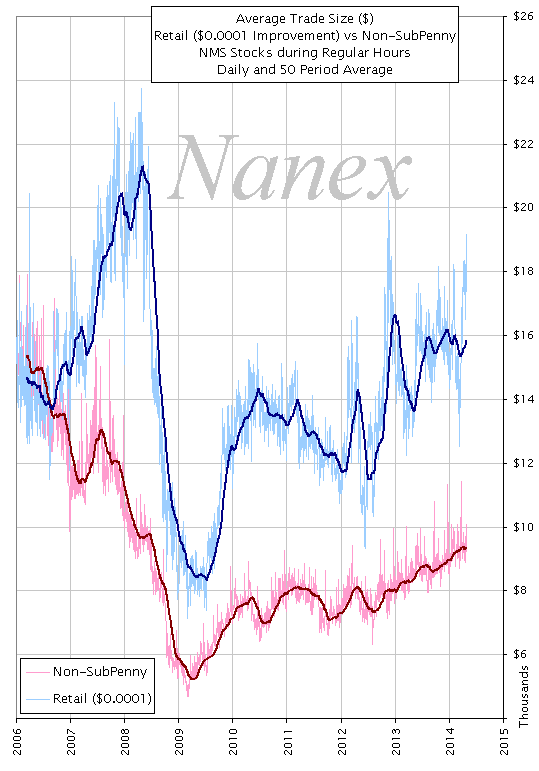

The average value of a retail trade dropped by more than half during the market swoon caused by the financial crisis of 2008.

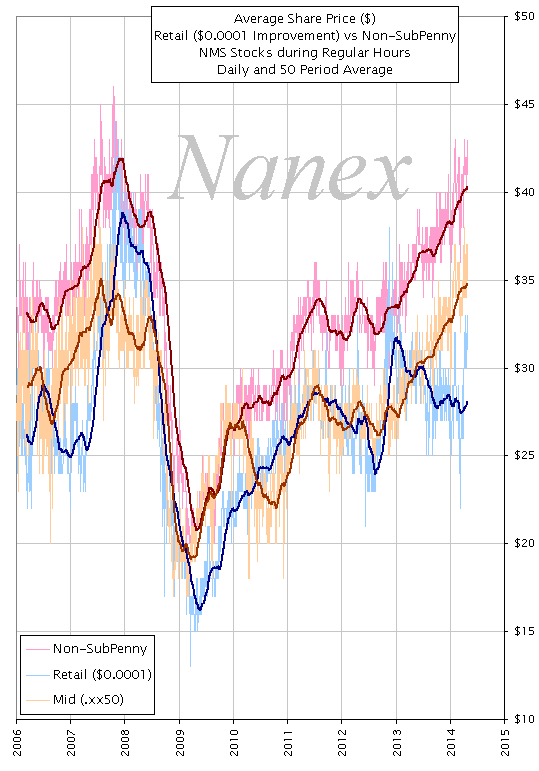

Note the dramatic drop in the value of midpoint price trades (right chart, brown) - from a high of $250,000 per trade to about $8,000 per trade today.

The average share price dropped by more than half for all categories during the market swoon of 2008.