Nanex Research

Nanex 06-May-2014 ~ Relentless Options

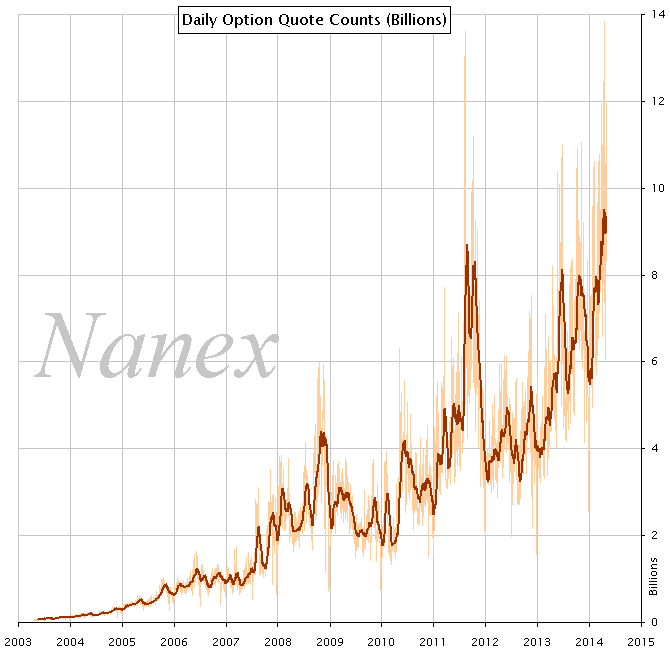

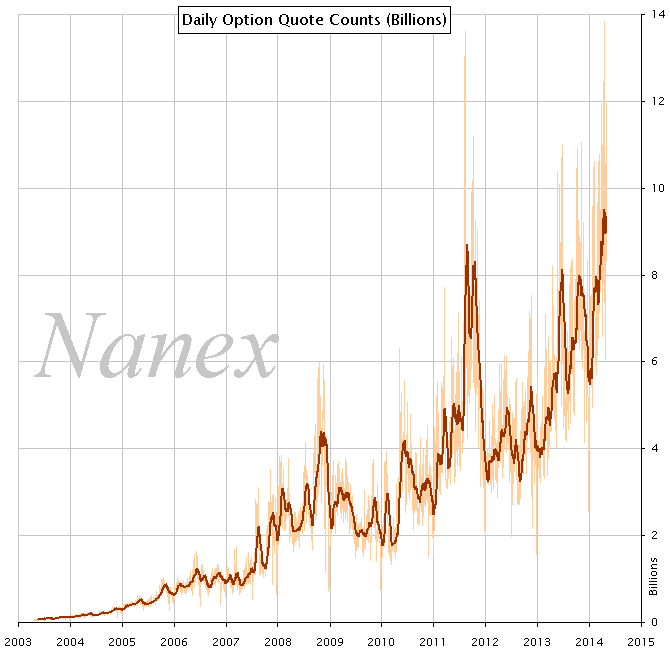

Charting the explosive growth of option quotes, from April 2003 through May 1, 2014.

1. Option quote counts march relentlessly higher - averaging almost 10 billion quotes

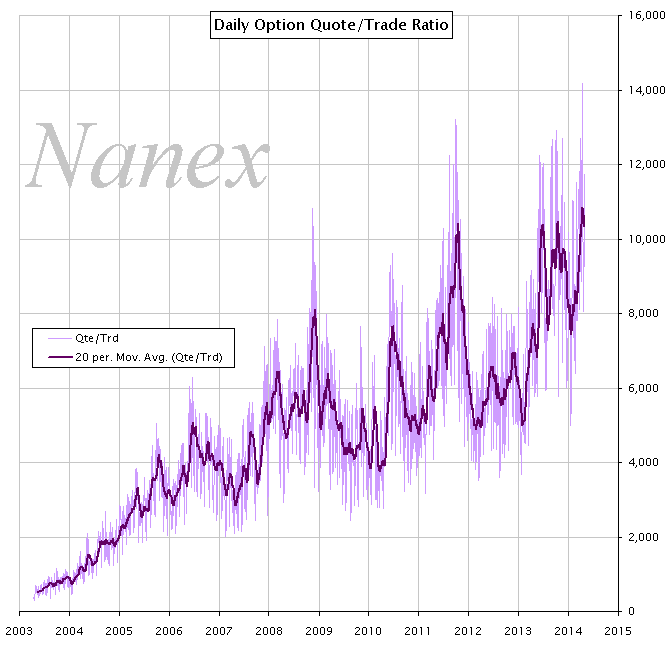

per day..

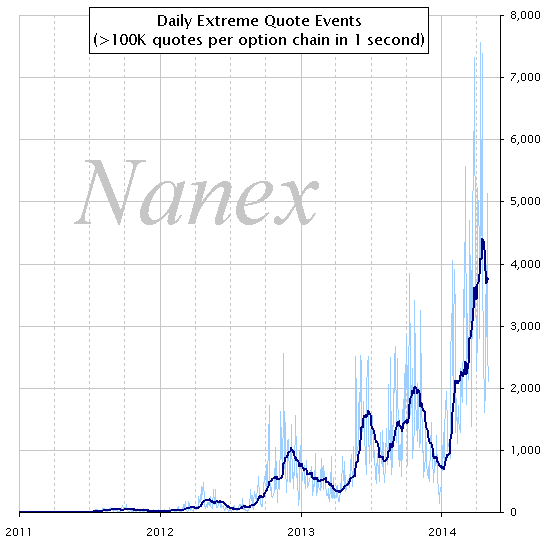

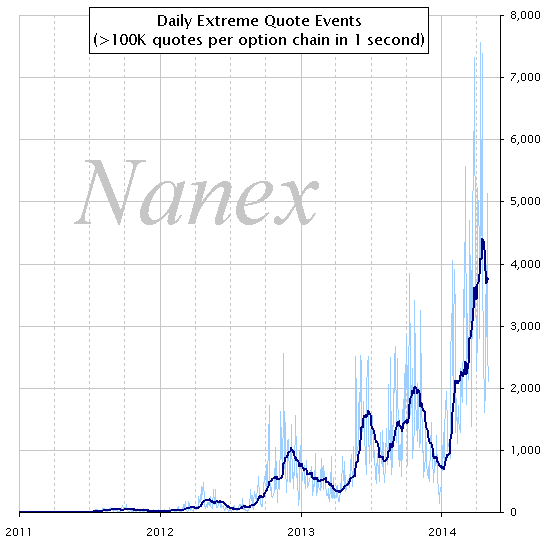

2. While the number of Extreme Option Quoting events skyrockets.

This is a count of instances where the number of option quotes for a given underlying

(SPY) exceeds 100,000 in 1 second of time.

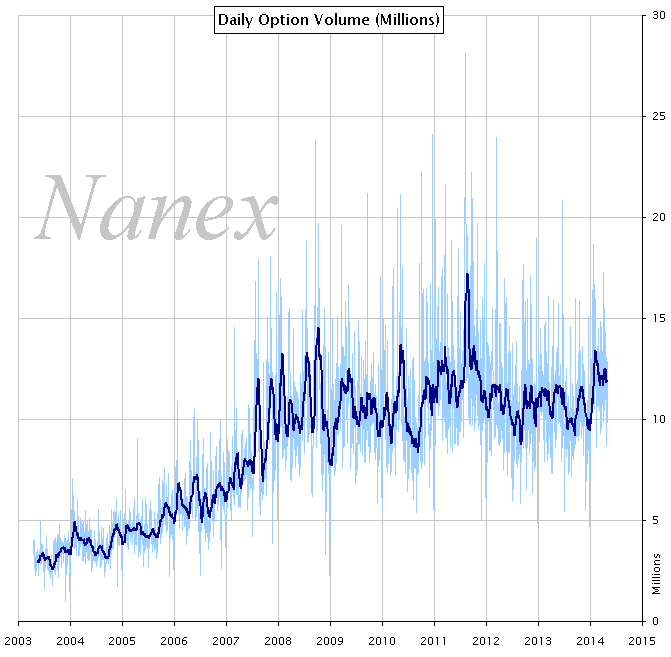

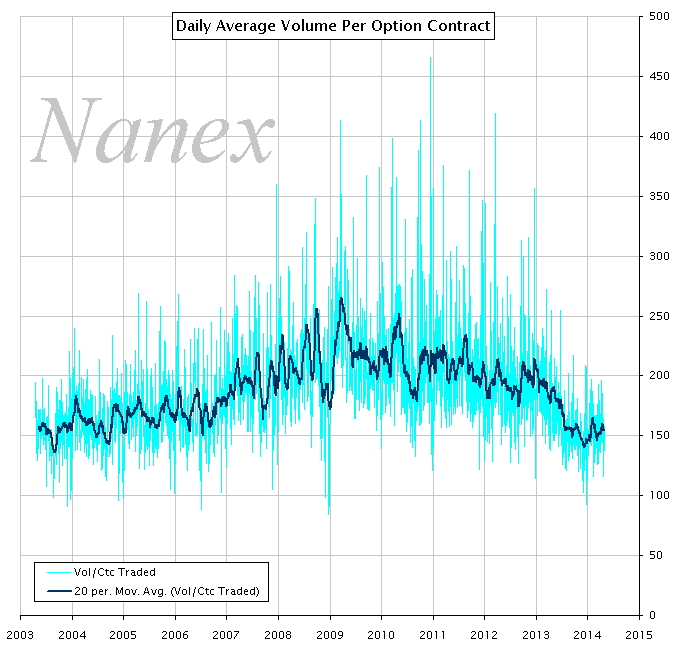

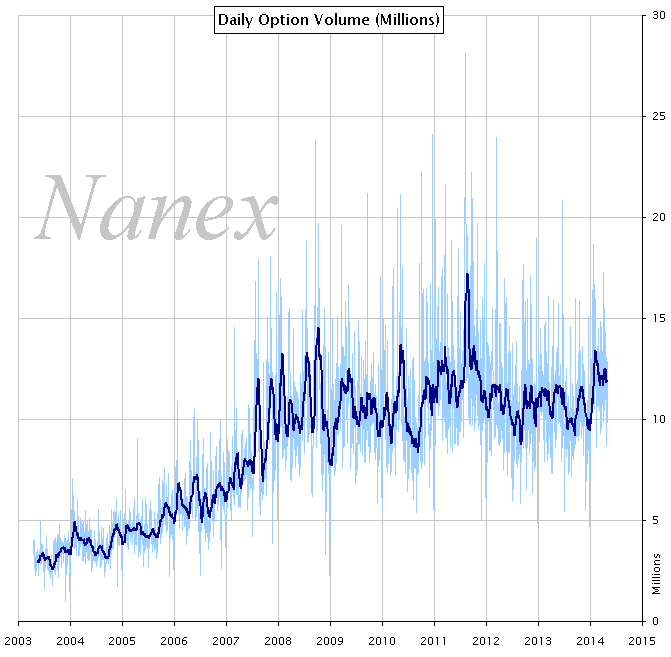

3. Yet, Option trading volume stagnates..

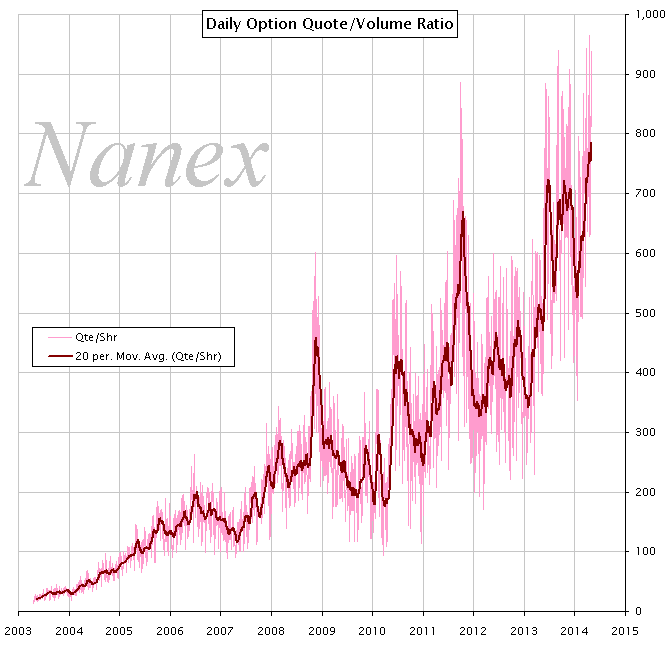

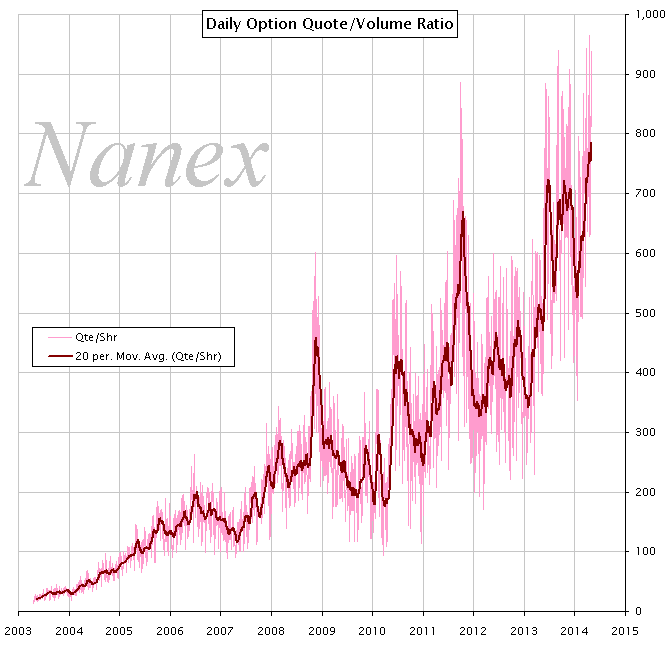

4. Leading to record setting Quote/Volume ratio..

It's taking a lot more processing to for each contract traded.

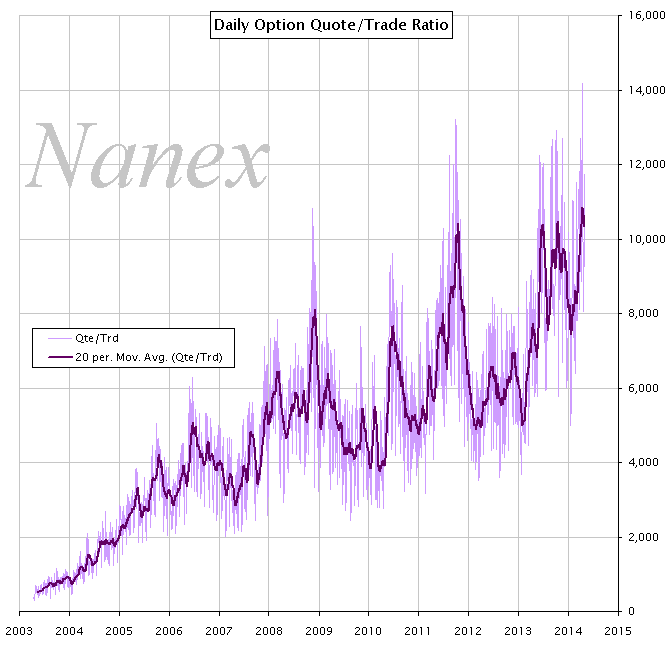

5. And an average of more than 10,000 Quotes per Option trade..

6. While the average size of an option trade continues to drop to record lows.

Average option trade is approaching 10 contracts.

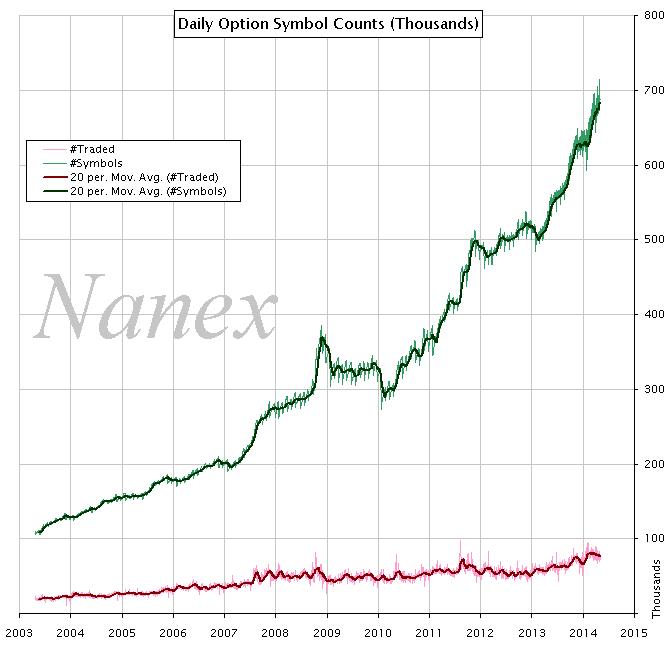

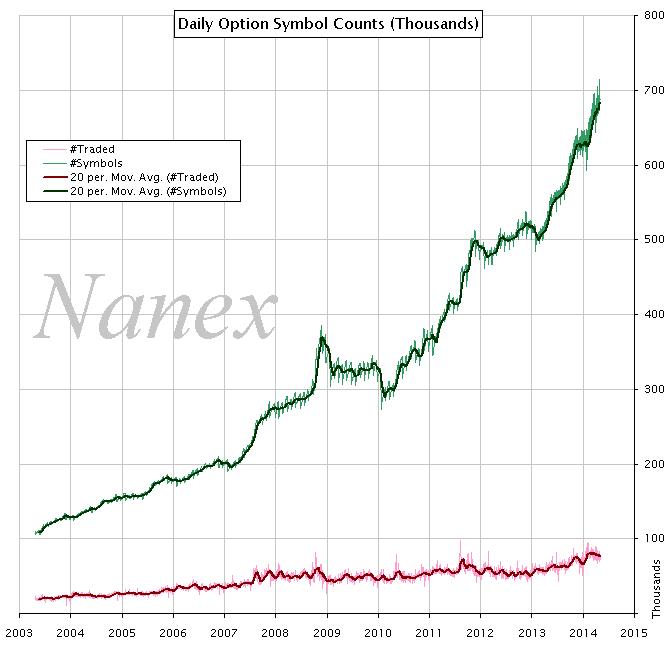

7. There are now about 700,000 individual option contracts: 80,000 of which

trade on a given day..

The marginal increase in volume shown in chart 3 is mostly from an explosion of weekly

expiration series.

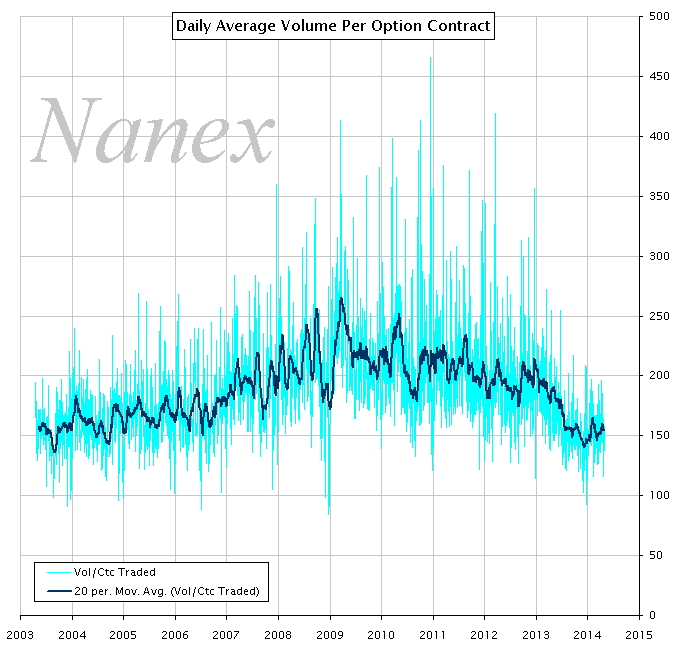

8. Sending the daily average volume per Option contract towards 10 year lows.

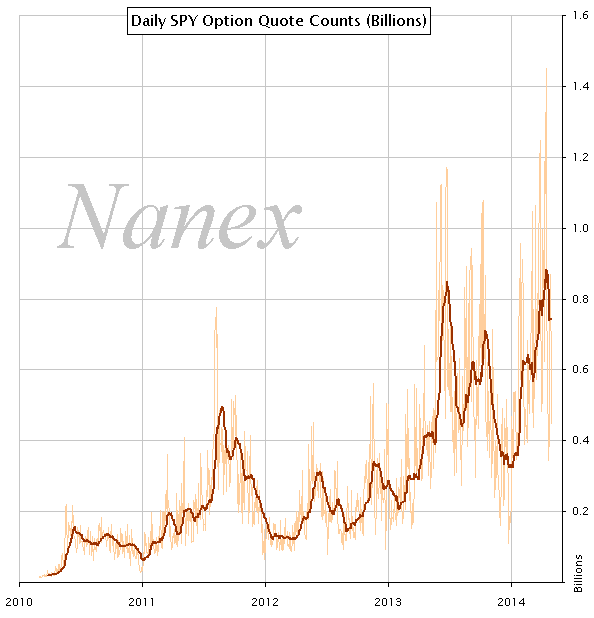

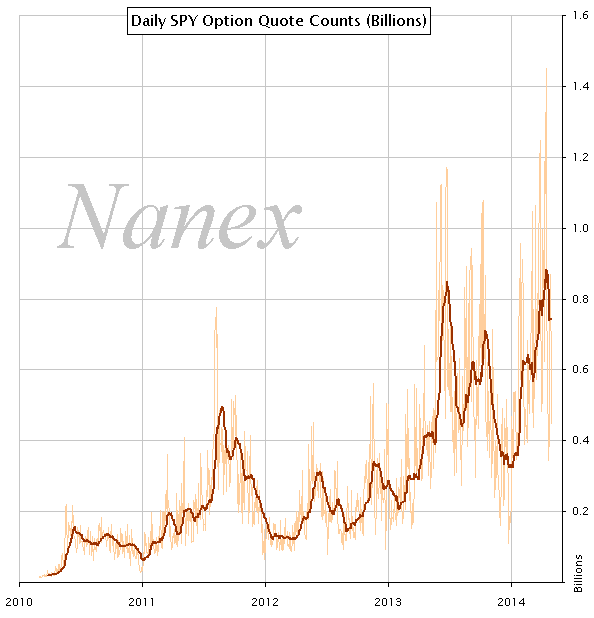

9. Looking at just SPY options, the number of quotes often exceeds 1 billion in

a day..

This is a subset of Chart 1 above.

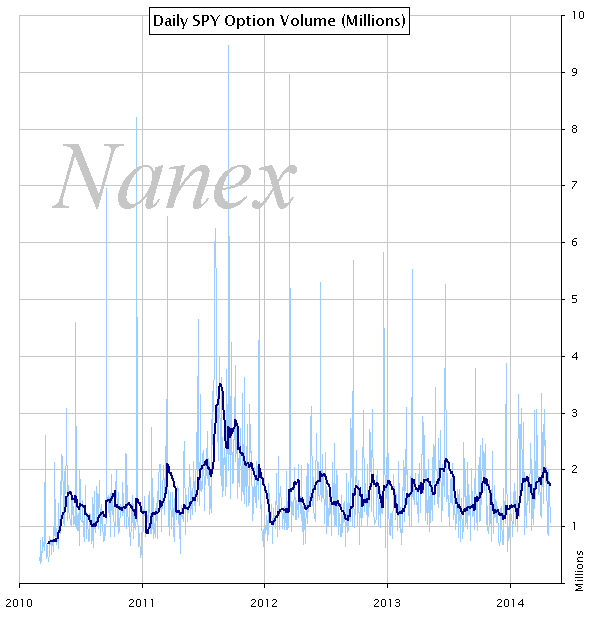

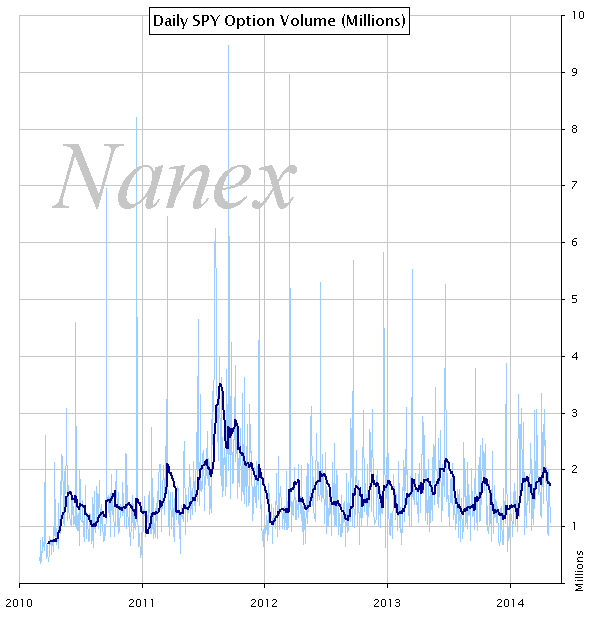

10. Yet, SPY Option trading volume stagnates.

This is a subset of Chart 3 above.

Nanex Research

Inquiries: pr@nanex.net