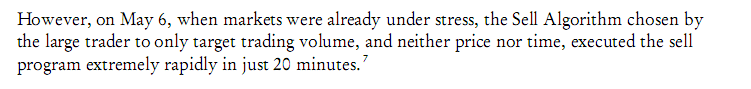

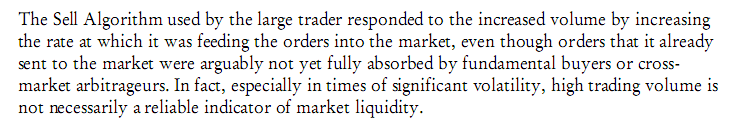

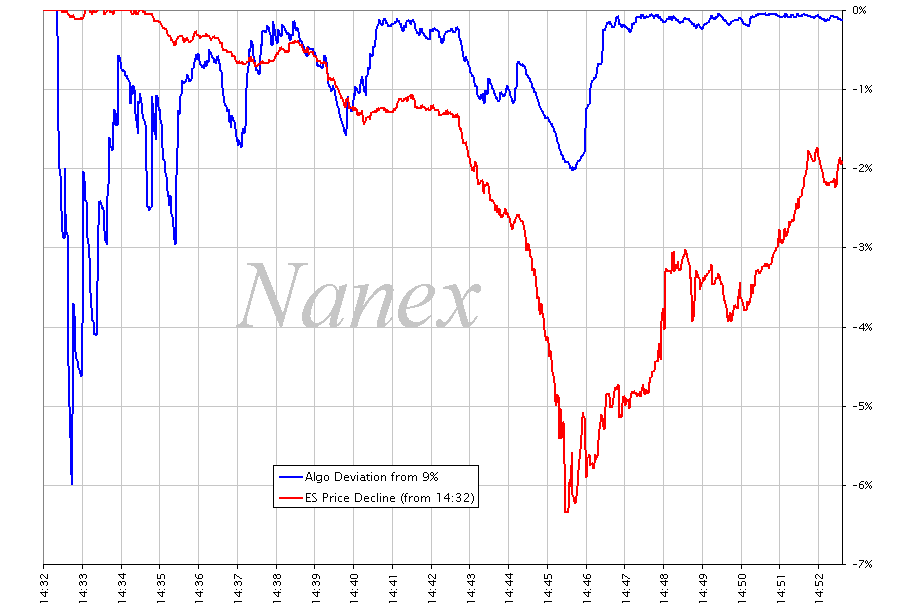

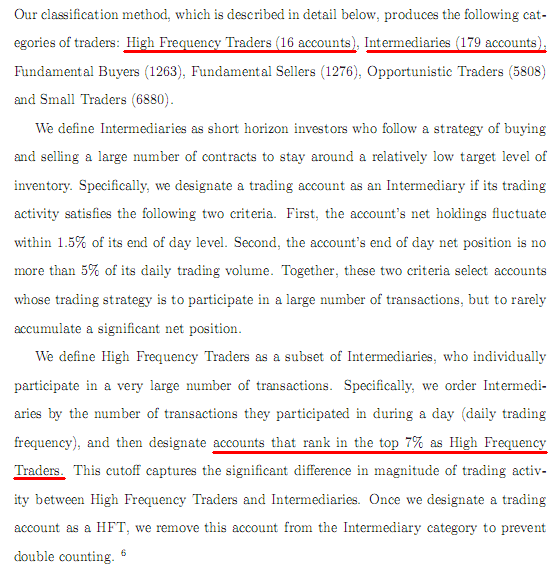

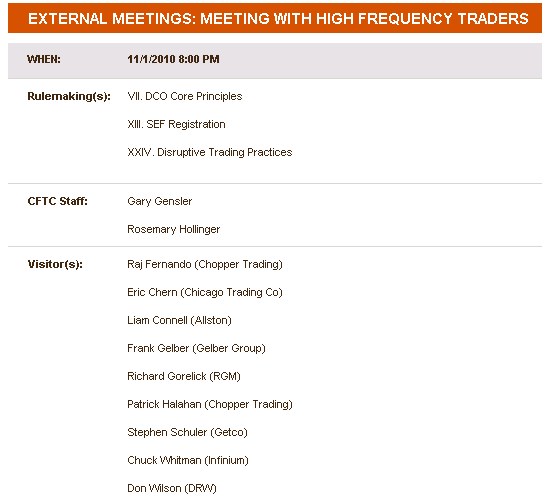

Several items jumped out from our second reading that we missed the first time through. Within a day of analyzing the behavior of the W&R Algorithm (the algo) from the actual W&R Trades (being the only private firm given this data), we knew something was significantly wrong with the SEC flash crash report. But now, with the benefit of hindsight and this timeline (shown below), we cast a keen eye looking for differences in the regulator's understanding of the algo over the course of meetings spanning 5 months, and noticed new information and backpedaling at the later meetings, especially the 05-Nov-2010 meeting after the regulator finally met with the person in charge of executing the algo they blamed just weeks earlier (read that story).

What stood out the most, was what seemed like a concerted effort to portray High Frequency Trading (HFT) in the best possible light. The contrast is greatest between the first and last committee meetings. We wonder if Gensler's private dinner meeting with top HFT influenced the 05-Nov-2010 meeting, just 4 days later.

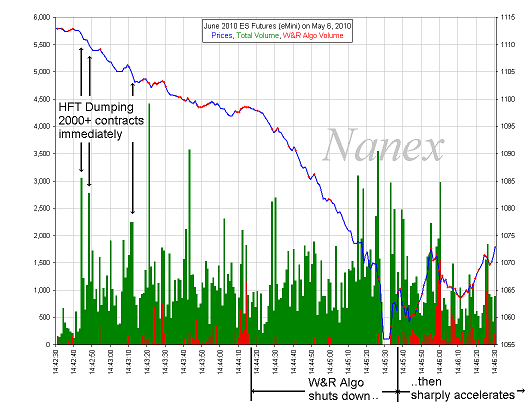

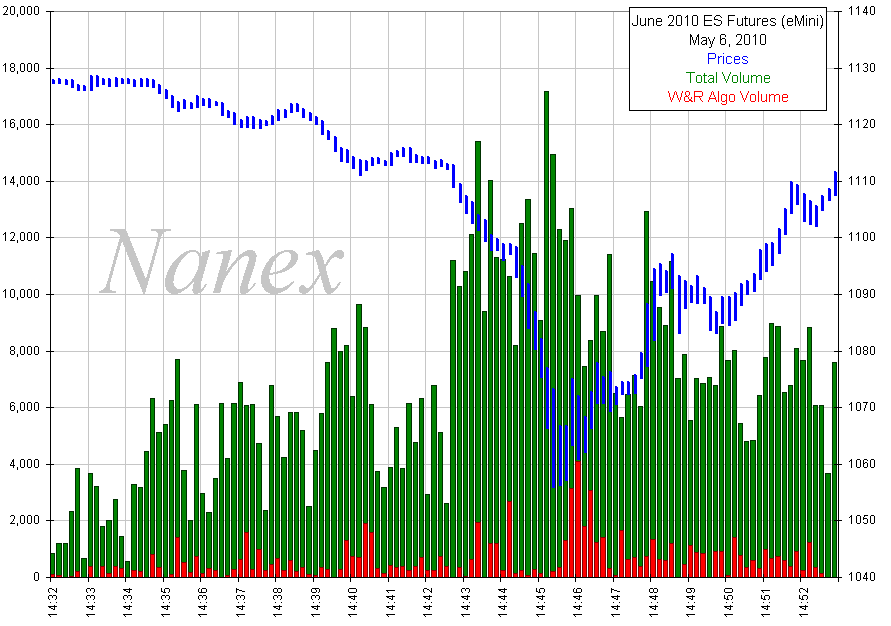

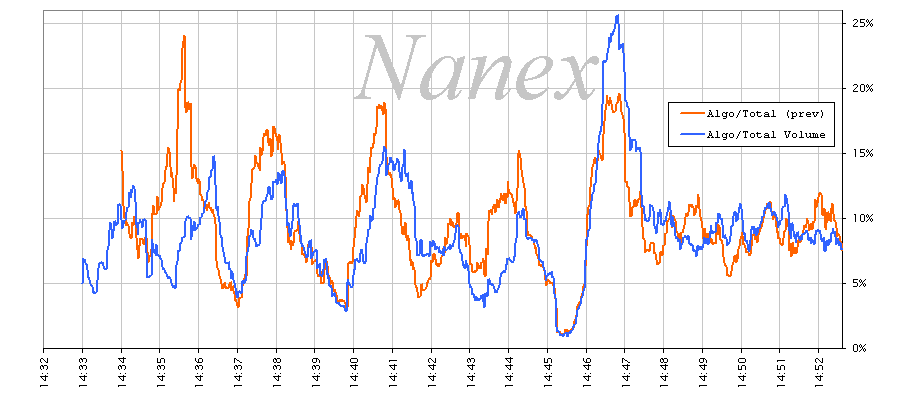

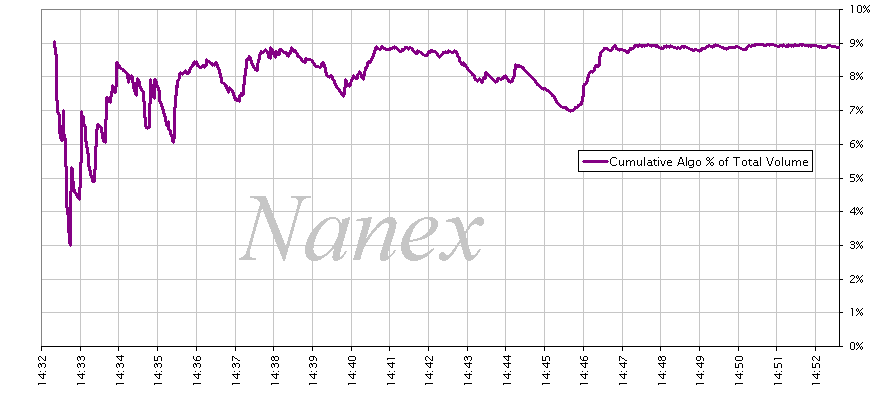

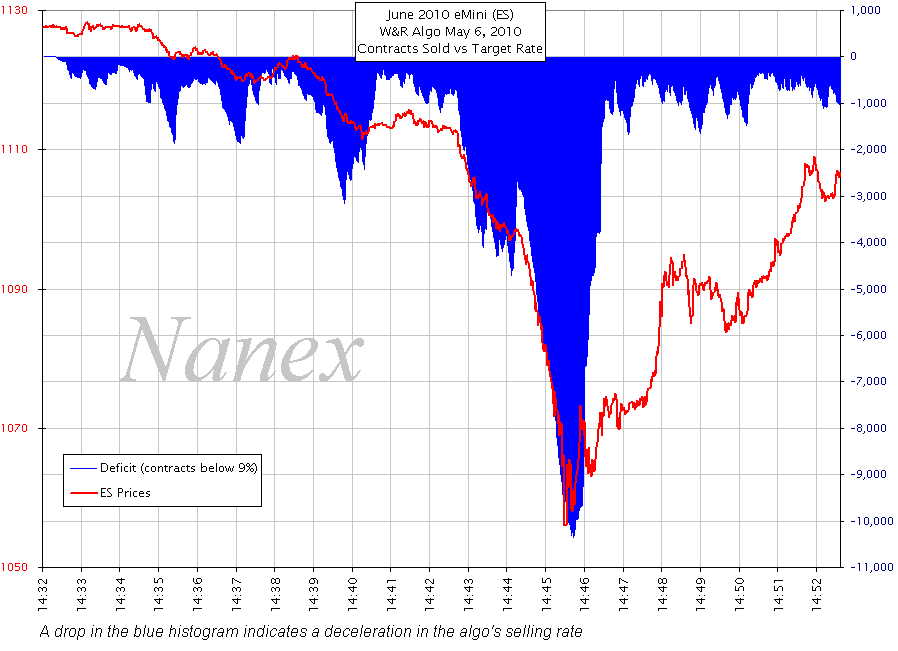

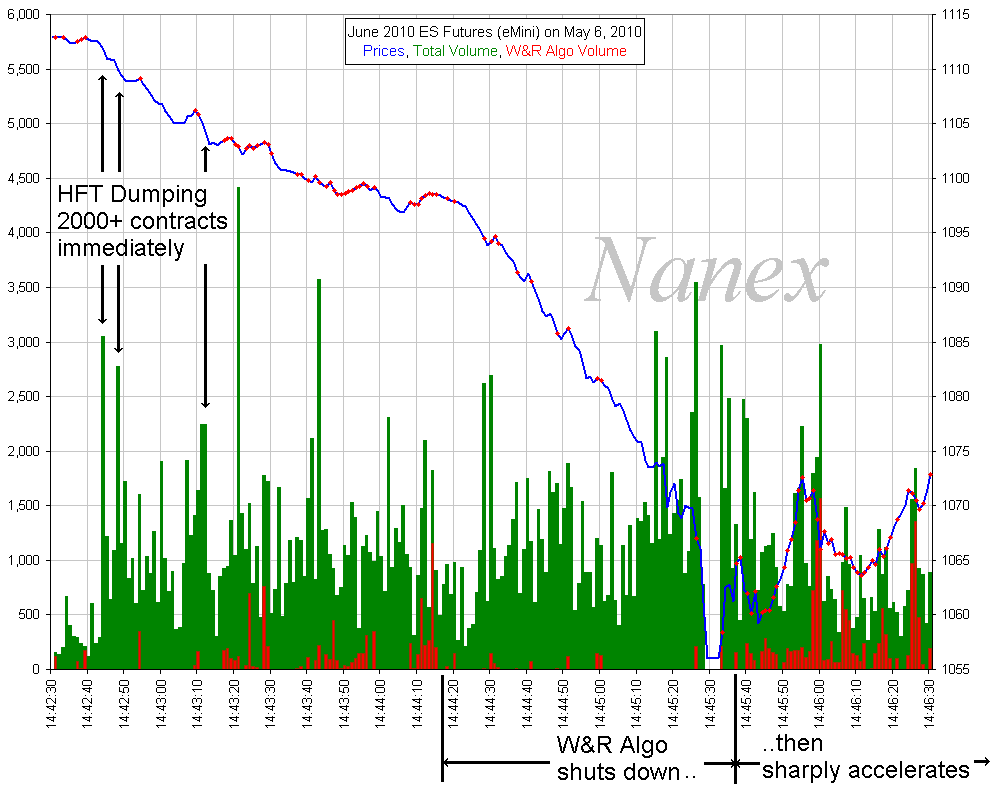

Throughout the transcripts, questions revolved around how much and how fast the algo was selling, with scant attention paid to HFT's super aggressive selling of 2000+ contracts immediately through the book at the very start of the flash crash. (see chart at right).