Nanex ~ 26-Jun-2014 ~ All Bite, No Barc

NY Attorney General Exposes Fraud in the Stock Market

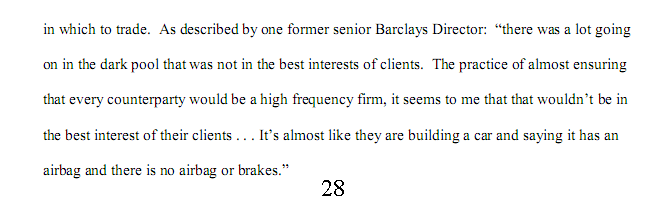

On June 25, 2014, the Attorney General for the State of New York announced a lawsuit filed against Barclays, alleging fraud. Reading the lawsuit, it quickly becomes clear, that not only was Michael Lewis right in Flash Boys, but Wall Street has become a cesspool of corruption and criminal activity. Strong words, to be sure, but let's start with how a former senior-level Director within the Equities Electronics Trading division at Barclays described the scheme:

The High Frequency Traders make their money "manipulating the price", get special concessions to do it, and the buy side is charged a fee for this service? And the broker was OK with this? The manipulation revelation adds a new dimension, because industry insiders are confirming our price manipulation evidence.

This action calls into serious question the MANY investigations of Dark Pools, HFT and manipulation by FINRA and the SEC which collectively turned up nothing. How is it that the NY Attorney General found the smoking gun after just months of effort, when significantly larger organizations (SEC, FINRA) with multi-million dollar tools (MIDAS - built by a HFT) failed after years and years of effort?

There's more. The lawsuit illustrates how some HFT can generate near perfect trading records, practically money machines - surely that must come from HFT's great investments in technology and their armies of PHd's? Not at all, it's actually just high technology masking an age old scheme.

HFT is not about great technology, it's about special advantages. To be a successful HFT:

1. You need low or free commissions:

2. You need to be cross-connected (co-located):

3. You need faster data feeds, and if the accomplice (exchange/dark pool) uses faster direct feeds instead of the SIP, ask them to slow down their direct feed processing:

4. You need special information (the equivalent of the special order type scheme discovered in lit markets):

5. You have to ask for (conspire), and get, special treatment and features:

6. And you need a timid press that doesn't know how to ask the right questions:

..and even gives out undeserved glowing reviews:

The solution is simple.

Start with requiring the SIP to be the standard reference price. That's at the heart of Reg NMS - and would go a long way to fixing the problem. Direct feeds are OK, but only if information in direct feeds is available no sooner than information is available from the SIP. This will allow much easier auditing to ensure compliance.

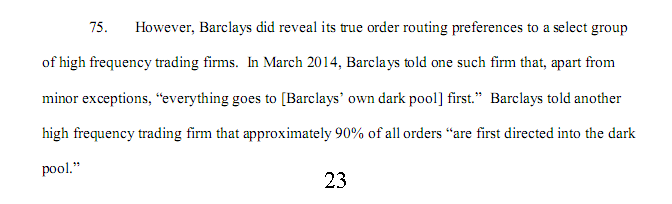

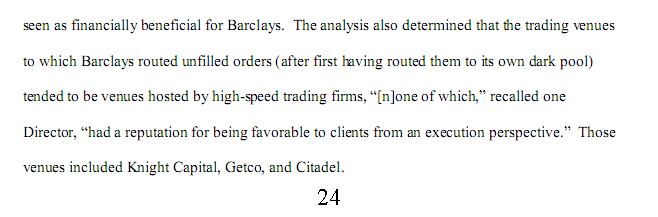

It's time to audit Wall Street's order routing code. Trust but Verify kept the the U.S. and Russia from blowing up the world in the 80's, perhaps it can keep Wall Street from blowing up the financial world today. It is clear that Wall Street is conflicted:

and

And finally, does the lawsuit hint at more names to come?

Download the lawsuit here (text, or pdf).

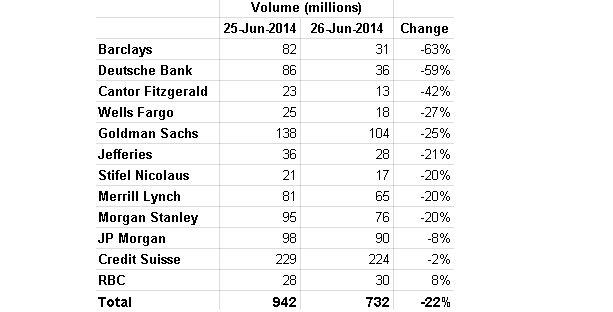

Market Impact

Table showing volume changes before and after the lawsuit was filed. Volume is based on Indications of Interest in Top 100 symbols

Barclays Presentation Materials

Listen to Bill White explain their dark pool back in 2012 (jump to 1:33:50).

Download the original charts from Barclays presentation.

Responses to HFT FUD (Fear, Uncertainty, and Doubt)

1. Only IOC pings in dark pools are predatory.

How is it even remotely appropriate for any broker with institutional clients to allow co-located and cross-connected small lots of passive HFT liquidity in their dark pool and then consistently and sequentially check their dark pool just prior to routing every institutional order to other markets? That is systematic electronic front running. That is predatory. Lying in wait.