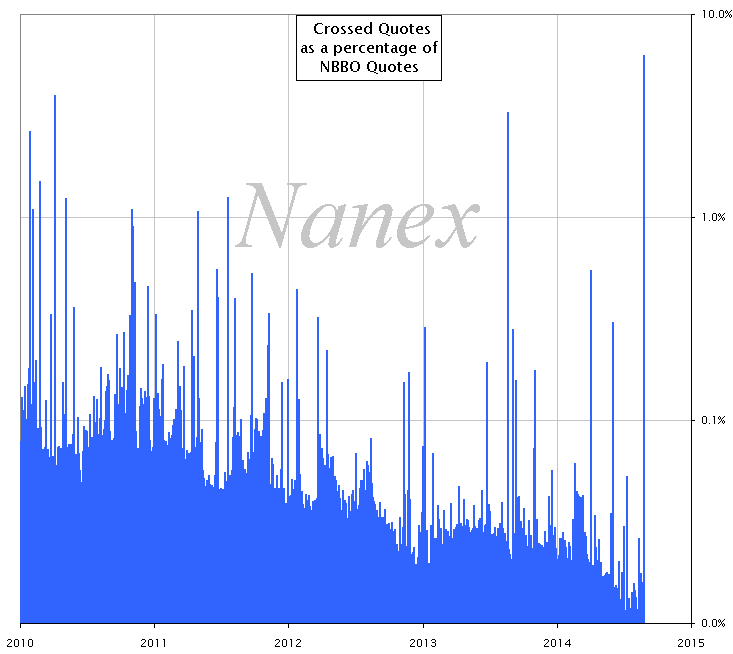

On August 26, 2014, starting at 11:58:25 and mostly ending at 12:37:27, quotes from FINRA ADF stopped updating and remained frozen, causing over 6 million of crossed NBBO quotes (bid price is greater than ask price) in 1,384 stocks.

There was a second period of crossed NBBOs, an after-shock, starting at 13:42 and running until just after 14:14.

All told, during regular trading hour, there were 6,022,833 crossed quotes, which was 6.2% of all NBBO quotes, and 1.7% of all top of book quotes. The 5 previous days averaged 16,080 crossed NBBOs each day.

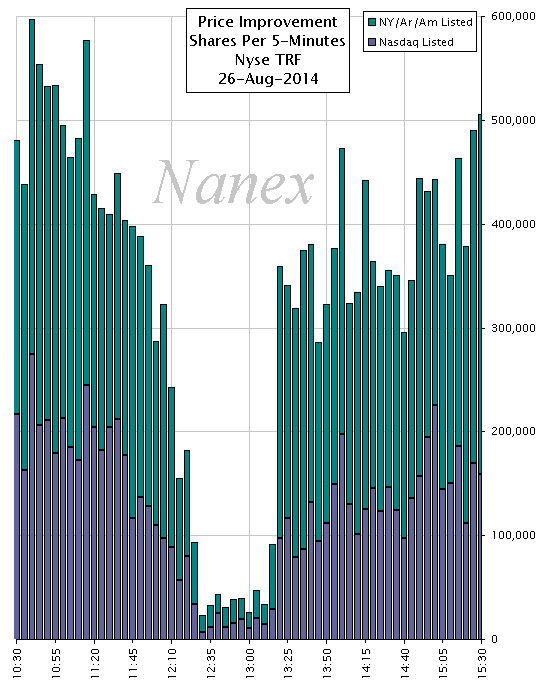

When NBBO quotes are crossed, most retail platforms and many dark pools will reject customer orders, or hold them until the condition clears. Worse, many investor protections, such as trade through, are suspended. Furthermore, execution quality reports (SEC 605) can (and will) ignore evaluating order execution quality during the time the NBBO is crossed.

Exchanges and facilities that send quotes in NMS stocks to the SIP are required to have procedures in place to prevent stale quotes from locking or crossing the NBBO. Clearly, FINRA is lacking those procedures.

1. Number of instances where a symbol had a crossed NBBO quote during 1 second of time.