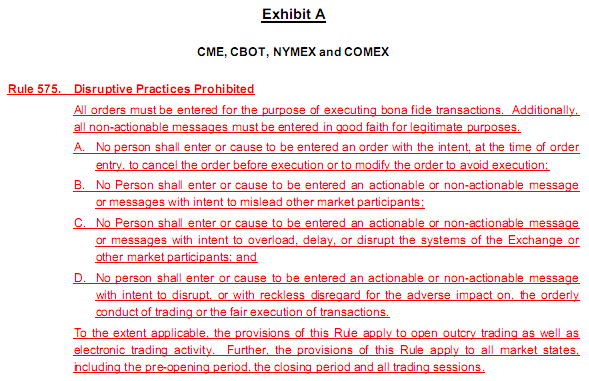

Beginning September 15, 2014, CME's new rule 575 ("Disruptive Practices Prohibited") goes into effect. The document accompanying rule 575 describes many of the issues we have pointed out and published over the years. Although these manipulative strategies have been illegal in the past under existing prohibitions on manipulation (see the CFTC Panther fine), rule 575 explicitly lists several types:

The document accompanying rule 575 also includes several examples of prohibited activity. The first is the placing of large orders to influence prices.

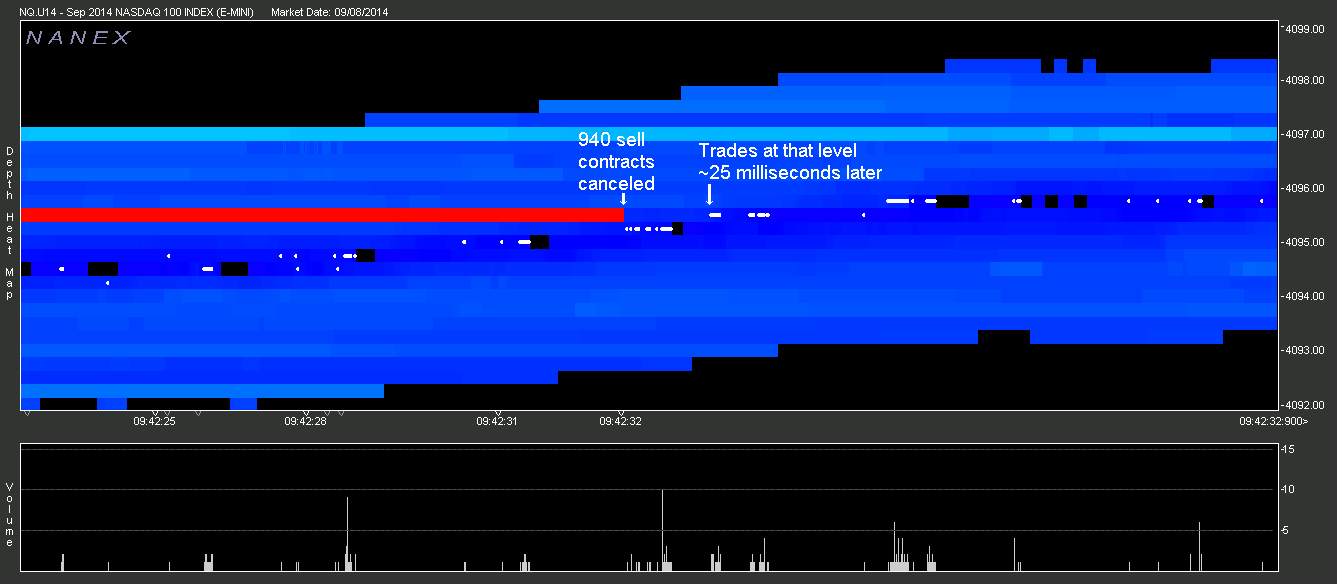

Below, is a likely real world case of the example described above. These are quite common: we simply pulled the first obvious example from today (September 8, 2014).

1. September 2014 Nasdaq 100 (NQ) futures contract depth of book. (How to read)