Nanex ~ 12-Dec-2015 ~ The IEX Comment Letters

The People Have Spoken

Rarely does a citizen have the opportunity to effect real change in government by merely voicing their opinion.

Submitting a comment letter is simple, choose 1 of these 2 methods:

- Click on this link and fill out the online form (be sure to read 1st note below).

- or Send an email to rule-comments@sec.gov with the subject line of your message referencing "File No. 10-222"

Notes:

- When filling out the online form, do not paste from a document such as Word - anything other than plain text will be rejected.

- Ignore the "Comments Due" date. The SEC will continue to accept and post comments.

- After submitting your comments, the SEC will post it here, usually by noon the next business day.

- You can submit multiple comment letters (Citadel has submitted 3) though probably best to limit yourself to 1 per day or week.

- To increase the impact of your comment letter, continue reading below.

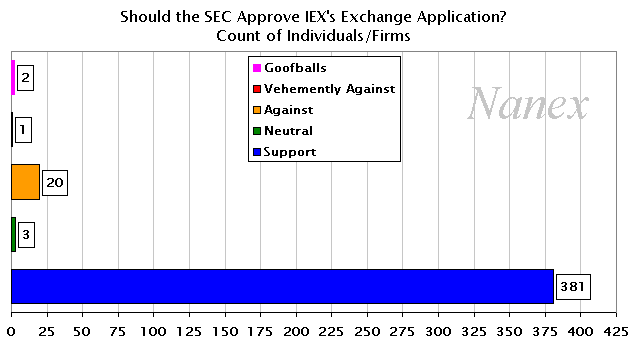

Last week, we asked our followers on twitter (@nanexllc) to submit comment letters to the SEC regarding IEX's application to become an exchange. Many of you responded, which not only diluted the few negative comments from established players (see chart above for a tally), but got the direct attention of the SEC and members of Congress. They are listening. We have their attention.

A few notable comment letters so far (there are so many others, it was hard to choose):

- Suzanne Shatto - This one is stunning. It includes a table of how lobbyists are working to block IEX

- Goldman Sachs - the pro-IEX comment the NY Times incorrectly characterized as anti-IEX before making a correction.

- Doug Cifu - Virtu - CEO of public HFT firm Virtu supports IEX.

- Themis Trading - key points from veterans in the business. Letter 1, Letter 2.

- Nanex CEO Eric Hunsader - 1) Reg NMS Covers IEX Now, 2) Latency Arb Documented, 3) Reg NMS vs Lobbyists

- Jefferies, LLC - Through independent research, Jefferies challenges the allegation of IEX router’s “unfair advantage.”

- Byron Fields, Managing Partner, Austin, Texas Victim of fading liquidity in execution of retail-sized orders urges SEC to take a stand.

- Michael Lewis, author of Flash Boys, who was inspired by this page.

- Norges Bank (very large, long term investor - $288 Billion in U.S. Equities)

- T.Rowe Price ( $725.5 billion of assets under management)

- Lou Mannheim - fantastic comments

- Rajiv Sethi, Professor of Economics, Barnard College - Clear, concise, common sense.

- Larry Doyle

- Robert L. Sillcox - Retired CIO of Ontario Municipal Employees Retirement System (OMERS)

- Michael McCloskey, Triumph Capital Partners

- Neil M. Lancastle (Senior Lecturer, De Montfort University - formerly with Black Rock)

Side note: to those who follow @nanexllc on twitter and read negative posts about the SEC, you must understand that these posts are not directed at the many good and talented people within the SEC who are trying to do the right thing. Often, someone from a regulatory office (or even a Wall Street bank) will reach out and tell us to the effect: You have many fans here. We want you to keep speaking out, because it helps us overcome the enormous political battles required to unrig the market'.

So you can help those good people by giving them ammunition through posting comment letters.

How to increase the impact of your comment letter

Note: Last updated at 7am on 15-Dec-2015

You can make your comments as short as you want, or say whatever you want - they are your comments. However, to significantly increase the impact of your letter and get the attention of the SEC and Congress, incorporate one or more key terms discussed below.

- Protected quote

- NBBO

- IEX router

- Quote Fade

- Fair competition

- Transparency

- Internalization

- Latency Arbitrage

- Direct Feeds vs the SIP

- Brokerage timestamps

- Reg NMS

- Speed bumps on other exchanges

- Automatic quotes and cancellation rates.

Examples (feel free to use these verbatim, edited or for inspiration):

- IEX should be a protected quote because I want the chance to have my orders executed on a fair market that does not provide select participants with speed advantages.

- I intend to use the IEX Router because I can’t afford to build my own and I do not want my orders subject to latency arbitrage.

- Some of the comments ask the SEC to make self-serving interpretions of obscure passages in

Reg NMS (e.g. the passage on intentional delays was not to help millisecond

traders, but rather, was created to address

manual trading on the NYSE at the time Nasdaq wanted to compete electronically). Yet these same comment letters completely ignore

parts of Reg NMS that play a central role in the discussion, e.g. even a casual reader of Reg NMS will note that there is no language

allowing co-location.

There are even passages in Reg NMS that specifically state that if the SEC is faced with a choice between the needs long term traders, and the needs of traders requiring millisecond access, the SEC must come down on the side of long term investors.

- Why do exchange proposals continue to refer to the NBBO as defined in Reg NMS (Code of Federal Rules C.F.R. § 600(b)(42)), but behave as if the SIP doesn't exist (see Hunsader comment letter to SEC).

- I intend to use IEX so that my orders are not internalized and have a chance of executing against other investor orders as guaranteed by the Securities and Exchange Act of 1934.

- Do internalizers price my orders based on the SIP or Direct Feeds? The NYSE has stated that internalizers give me the SIP price (which has an intentional speed bump) yet trade on Direct Feed prices.

- I'm tired of watching my market orders not completely fill because of Quote Fade - the IEX Router would prevent that.

- Mary Jo White, the SEC Chairman, testified to Congress that she wanted to bring transparency, but it seems that some lobbyists and participants are being granted meetings that are not properly disclosed.

- Why do all my retail trades get executed by an internalizer, such as Citadel, who happens to be vehemently against the IEX application?

- Why is Citadel (an internalizer) so concerned with 0.000350 seconds, when my broker timestamps my trade reports to the minute?

- Why does it take Citadel 85 times longer to execute a 100 share order than the 350 microseconds they complain about in their 3 comment letters?

- Existing stock exchanges send their quotes and trades slower to the SIP than to their direct feeds. How is that not an intentional (and illegal) speed bump? IEX won't sell a direct feed with a speed advantage, which is exactly what Reg NMS specifies.

- Are exchanges using the best technology available to update the SIP? Overwhelming evidence points to an intentional speed bump.

- Those who wrote negative comments are asking the SEC to demand precise timing breakdowns (to the millionth of a second) from IEX, yet nowhere do existing exchanges disclose the many speed bumps (either intentional or through careless coding) in their systems.

- The Chicago stock exchange has an effective speed bump of 8000 microseconds (vs the 350 from IEX), yet Chicago has a protected quote and the sky is not falling.

- Which quote is more accessible (automatic): one that has to persist for 350 microseconds, or one that can be canceled before you can even see it? For example, according to statistics compiled by the SEC and published on their website, over 31% of all stock quotes have already expired by the time they reach California.

- A writer that submitted a negative comment has a problem with IEX because it will prevent latency arbitrage strategies - the same type of strategy that earned Virtu a $5.4M fine from the French Authorities just this month. Latency Arbitrage was a central manipulation device outlined in Flash Boys and proven to exist in painstaking detail.

- When did Latency Arbitrage go from "that doesn't happen!" to "it doesn't happen anymore" to "Latency Arbitrage must be allowed!"? Those who submitted negative comments are all basically saying that IEX will kill Latency Arbitrage and therefore IEX should not be allowed to be an exchange.

- My broker won't use the IEX Router now because IEX is a dark pool - isn't that against existing regulations that allow me to direct my orders? When IEX becomes an exchange, my broker says they will allow me to use the IEX Router.

Example Letter (but do not copy this verbatim - see warning below)

Dear SEC,

IEX should be a protected quote because I want the chance to have my orders executed on a fair market that does not provide select participants with speed advantages and I don't want my orders sent to an Exchange that identifies my orders as being from a retail investor (BATS/EDGX, NASDAQ, NYSE). I intend to use the IEX Router because I can’t afford to build my own and I do not want my orders subject to latency arbitrage.

Thank you.

John Q. Public, Investor

Warning - if you submit the example letter shown above then the SEC will set your comment aside like this: