This story in the news

Worth reading:

Honorable Mention:

Conspicuously Absent

- New York Times

- Financial Times

- Bloomberg

Summary

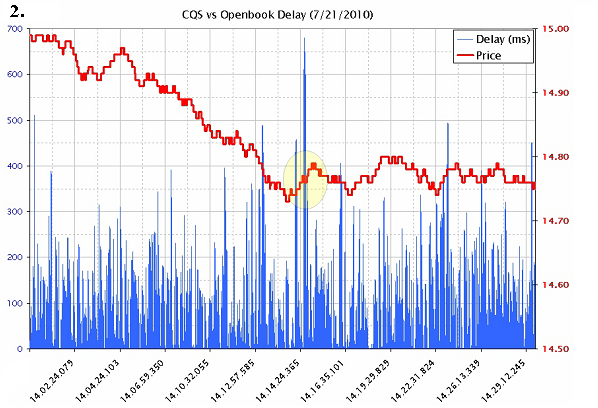

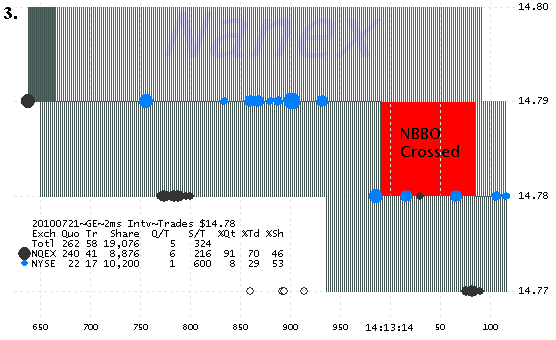

On July 21, 2010, Congress signed into law, as part of Dodd-Frank, a new Whistle-blower program, which Hunsader wouldn't learn about for several more years. That same afternoon, Hunsader was comparing the quote time-stamps in General Electric (GE) common stock between the SIP and NYSE's direct feed (Open Book).

What Hunsader discovered over the next few hours would become crucial evidence that led to the historic

$5

Million fine against the NYSE on September 14, 2012. It was the first time

the SEC had ever fined a Stock Exchange.

The January 15, 2016 SEC press release "SEC

Awards Whistleblower More Than $700,000 for Detailed Analysis" had this

to say about Hunsader's analysis:

“The voluntary submission of high-quality

analysis by industry experts can be every bit as valuable as first-hand knowledge

of wrongdoing by company insiders"

When the SEC called Hunsader in June 2015 to tell him about the award, he said to them:

"I would have accepted $1 if you simply acknowledged me at the time."

This page succinctly summarizes what

Hunsader was referring to about being acknowledged.

Hunsader will use the award money to pay for college education for his four daughters:

basically the capitalist approach to Bernie Sander's idea to tax Wall Street to fund

college education.

High-Quality Analysis and the Discovery

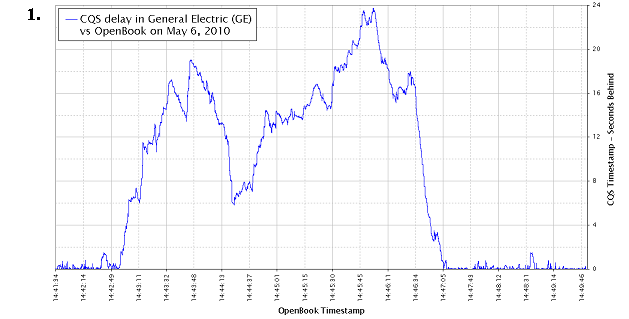

Nearly 6 years ago, while analyzing the May 6, 2010 flash crash in detail, we discovered one of the prime causes for the crash, and a serious

violation of a regulation that

governs how stocks are traded in the United States (Reg.

NMS). Specifically, we found

that stock quotes from the NYSE were delayed by more than 30 seconds

to the public quotation feed (chart 1),

relative to Open Book, which is NYSE's

expensive direct feed product used mostly

by High Frequency Traders (HFT).

|