Update: April 11, 2012

Watch a video

of the emini depth of book and an equity hot list as it looked during the flash crash.

Update: April 10, 2012

We recently reread the paper from Andrei Kirilenko and Albert (Pete) Kyle titled:

The

Flash Crash: The Impact of High Frequency Trading on an Electronic Market. As you may know, Kirilenko was a primary author of

SEC final report on the flash crash,

and often the same language appears in both papers.

Based on interviews and our own

independent matching of the 6,438 W&R executions to the 147,577 CME executions

during that time, we know for certain that the

algorithm used by W&R never took nor required liquidity. It always posted sell orders

above the market and waited for a buyer; it never crossed the bid/ask spread. That means that none of the

6,438 trades were executed by hitting a bid. Therefore, the following statements from page 36 of Kirilenko's paper cast serious

doubt on the credibility of their analysis: (Similar language can be found in the

SEC final report starting at the bottom of page 14.)

Thus, during the early moments of this sell programís execution, HFTs

and Intermediaries provided liquidity to this sell order.

..

As they sold contracts, HFTs were no longer providers of liquidity to

the selling program. In fact, HFTs competed for

liquidity with the selling program, further amplifying the price impact

of this program.

It is widely believed that the "sell program" refers to the algo selling the W&R contracts. However, based on the statements above, this cannot be true. The sell program

must be referring to a different algo, or Kirilenko's analysis is fundamentally flawed, because the paper incorrectly identifies trades that hit the bid as executions

by the W&R algo. Another clue from page 31 of the same paper lightly hints at the

possibility of a different algo (or just adds to their confusion):

Specifically, between 1:32 p.m. and 1:45 p.m. CT, the 13-minute period when the prices

rapidly declined, Fundamental Sellers sold more than 80,000 contracts net.

We know that the W&R algo sold 34,942 contracts during this period, which leaves more than

45,000 contracts unattributed. Could these 45,000 contracts that competed with HFTs

for liquidity be from a different sell program? Probably not, because both papers

indicate the sell program sold a total of 75,000 contracts, the exact number sold

by W&R.

Original Text

Click for New Charts

Click for Final Conclusion

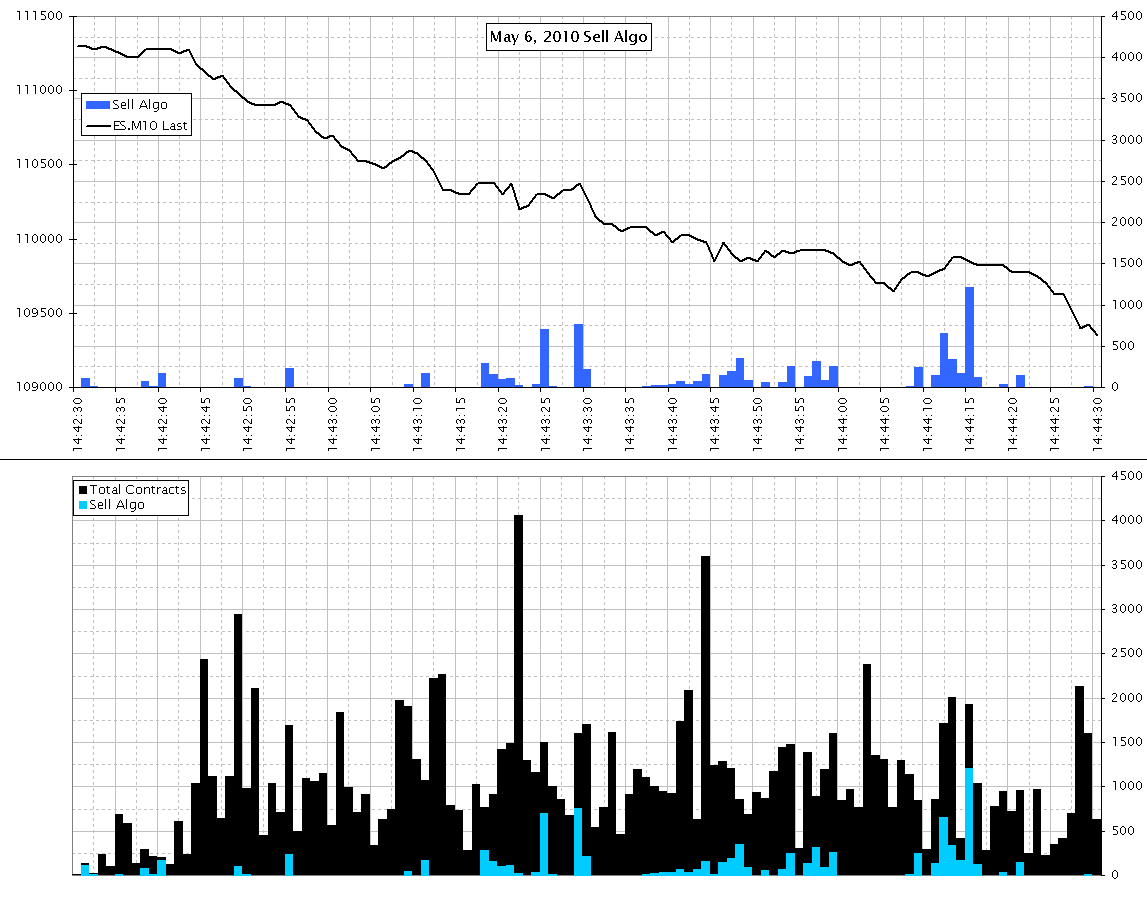

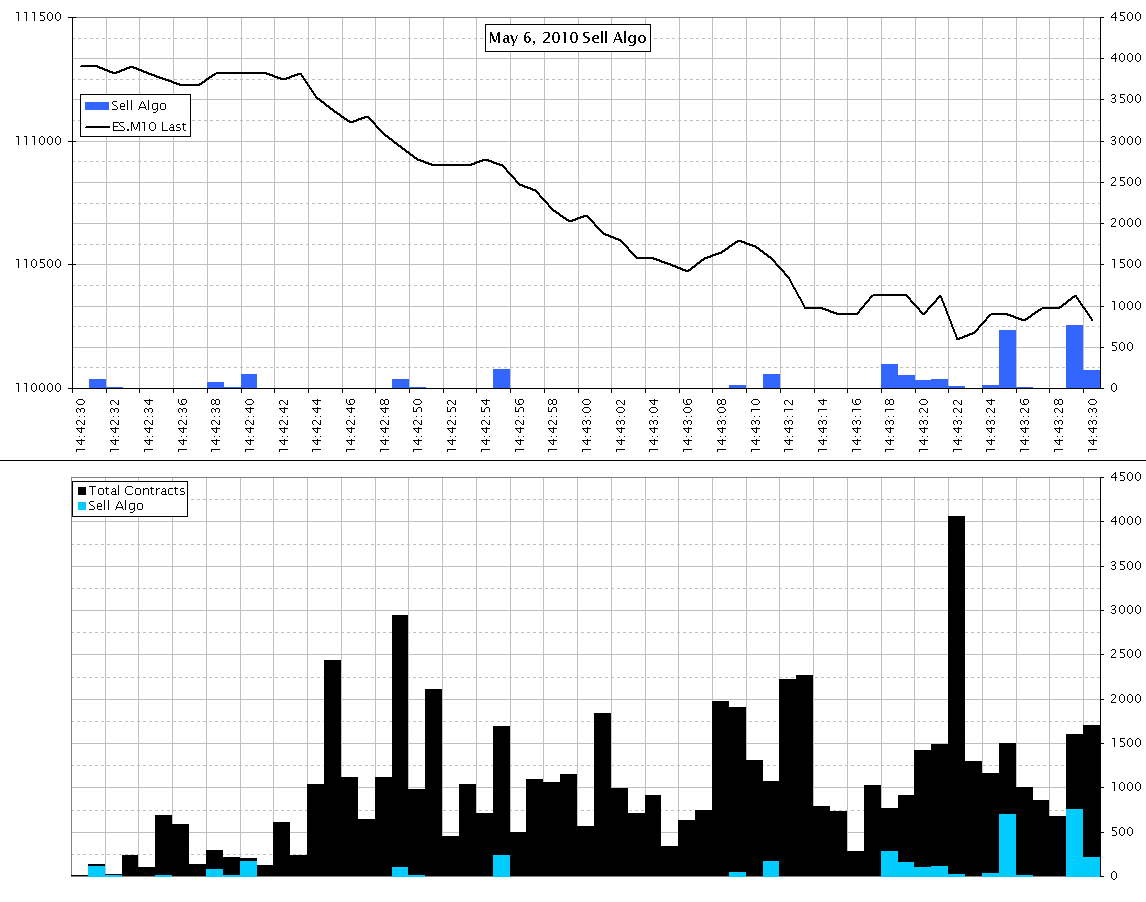

We have obtained the Waddell & Reed

(W&R) May 6, 2010 trade executions from the executing broker in the June

2010 eMini futures contract. There were 6,438 trades totalling 75,000

contracts. We matched them by time, price and size to the 147,577 trades

(844,513 contracts) in the CME time and sales data between 14:32 and 14:52

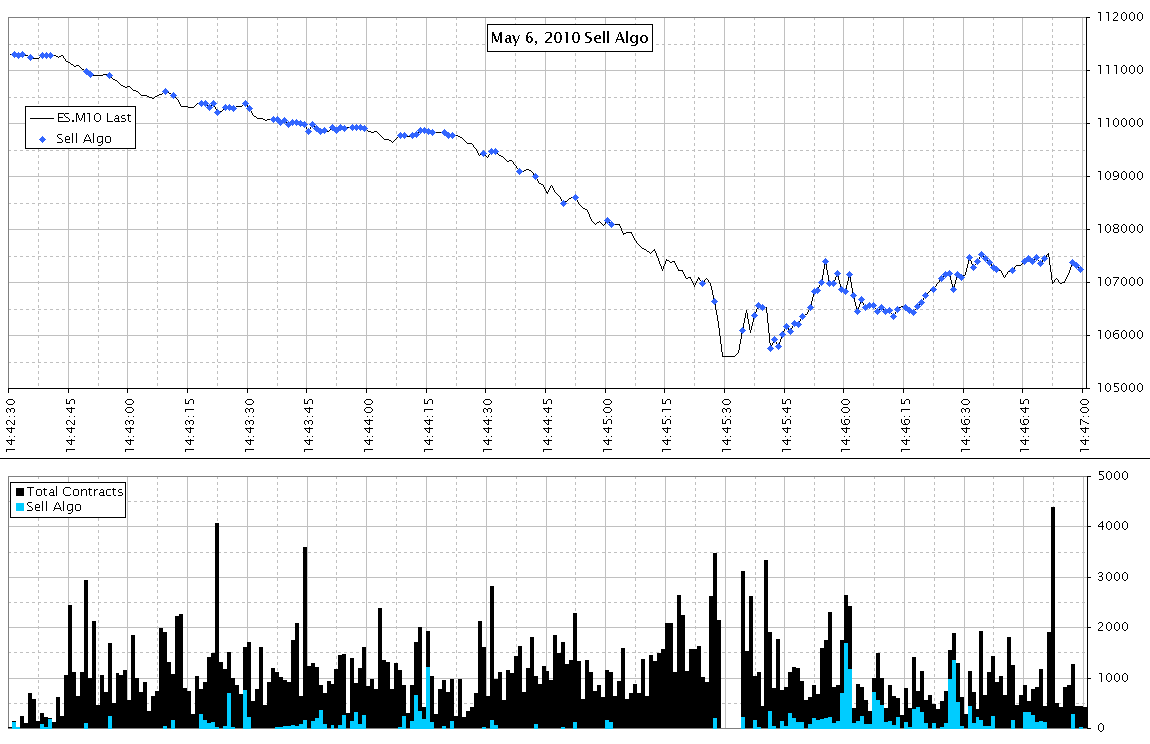

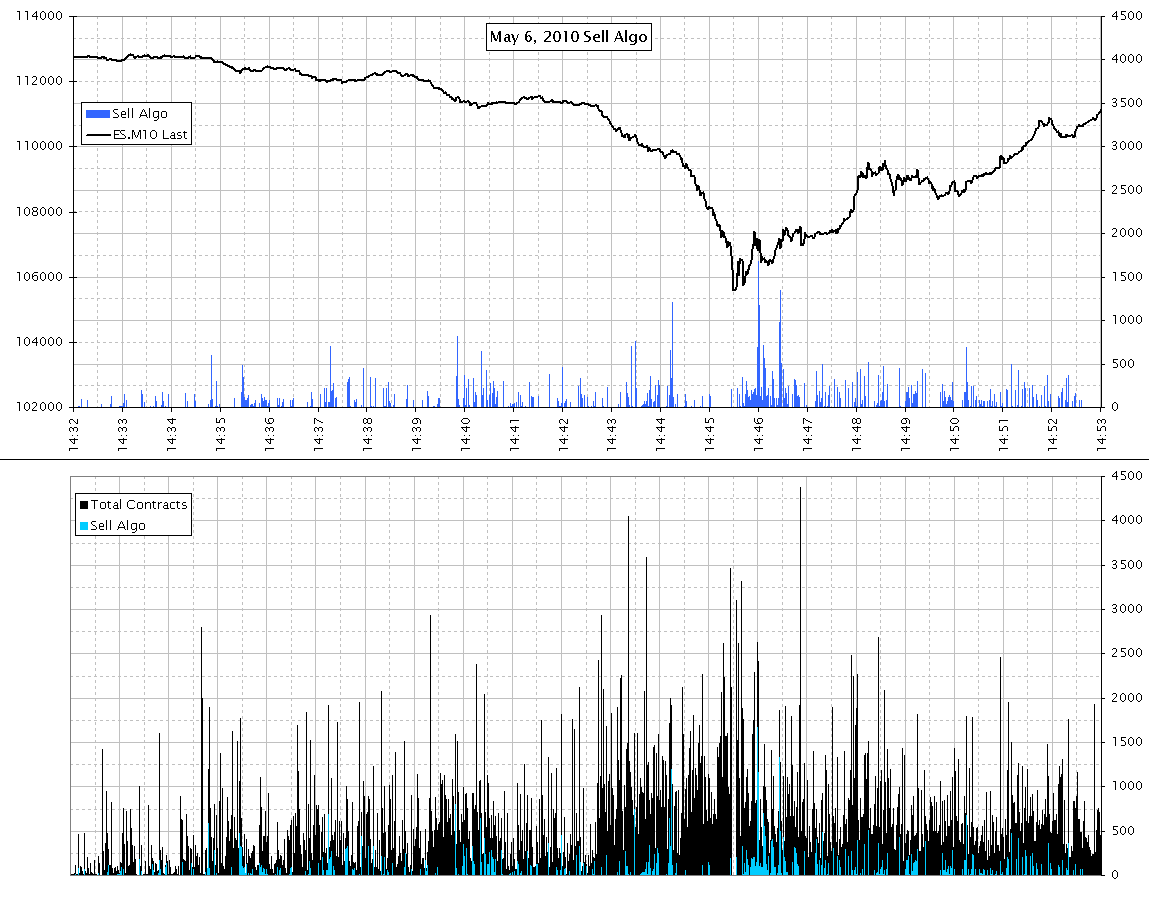

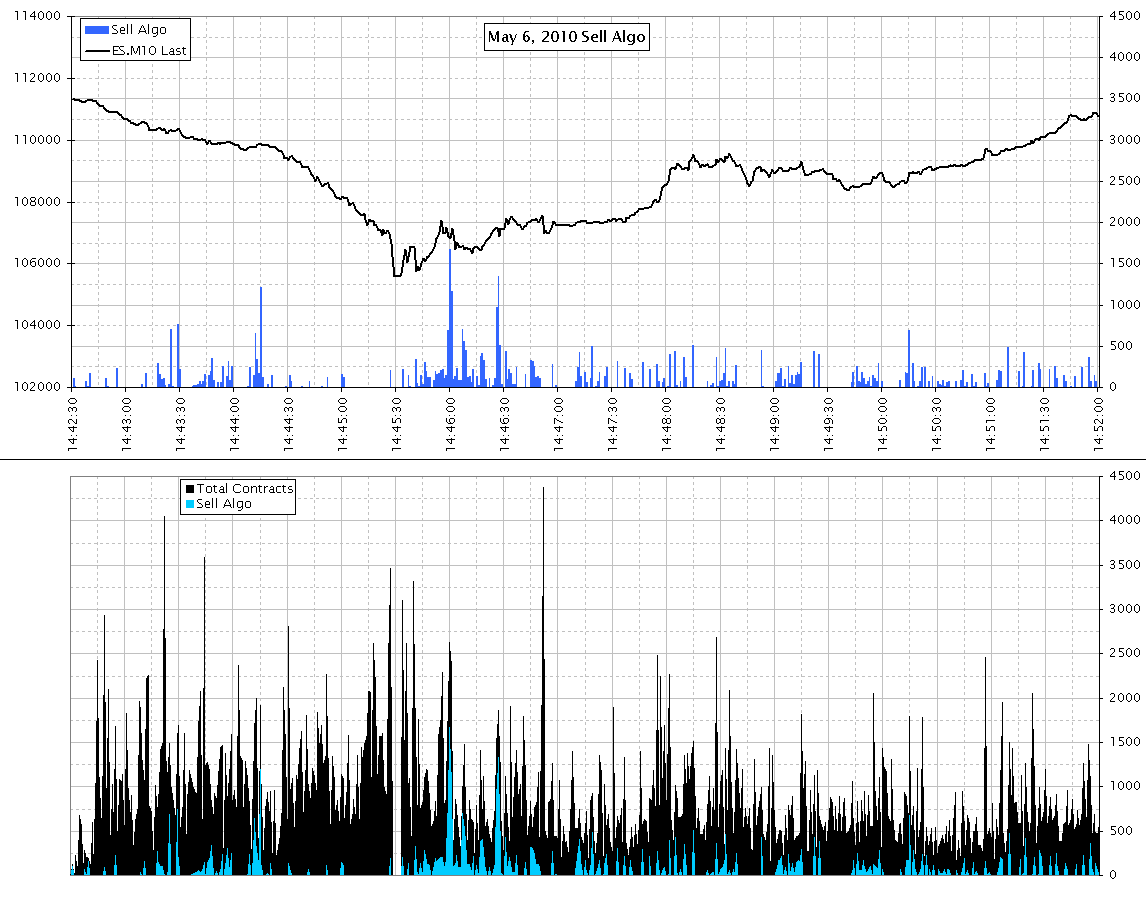

(they matched exactly). One-second resolution charts of the W&R trades

along with other eMini trades are shown below in various time frames.

The SEC report identified a Sell Algorithm selling 75,000 contracts as the

cause of the flash crash. If the "Sell Algorithm" in the SEC report

refers to the Waddell & Reed trades, then there is a problem. A big one.

Looking at the trades in context with the other trades during that time, they

do not appear to be significant. The W&R trades also do not occur near the

ignition point (14:42:44.075) we identified earlier. Furthermore, the W&R

trades are practically absent during the torrential sell-off that began at

14:44:20. The bulk of the W&R trades occurred after the market bottomed and

was rocketing higher -- a point in time that the SEC report tells us the market

was out of liquidity. Finally, the data makes it clear that the algorithm does

take price into consideration; you can see it stops selling if the price moves

down over a short period of time.

Something is very wrong here.

|

250 millisecond interval chart showing eMini depth and cumulative W&R contracts sold.

Note how the selling rate increases when the market moves higher. This is because

the W&R algo used mostly passive sell orders -- when a buyer aggressively

hits the offer price.

1 second interval chart showing eMini depth and cumulative W&R contracts sold.

Note how the selling rate increases when the market moves higher. This is because

the W&R algo used mostly passive sell orders -- when a buyer aggressively

hits the offer price.

|

|

Inquiries: pr@nanex.net

Publication Date: October 8, 2010

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|

|