The Legal Limit Algo - Table of Contents

|

Back to Main Research

Page

Update 04/06/2012: We have determined the

quoting sequences identified in this article are generated by the

BATS

Market Maker Quoter, the BATS exchange's Automatic Market Maker.

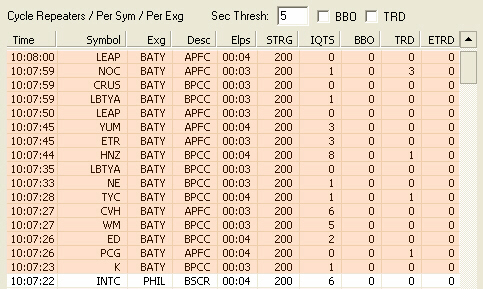

On June 28, 2011 while working on our algo monitoring application, we noticed

large numbers of bidprice/askprice climb/fall sequence cycles, all originating

from the BATY exchange:

The sequences were very curious and involved very liquid issues. Upon further

examination we discovered what we termed "The Legal Limit" algo, as

its order prices climb and fall from the tip of the required BBO distance

thresholds to the current price range and then repeating.

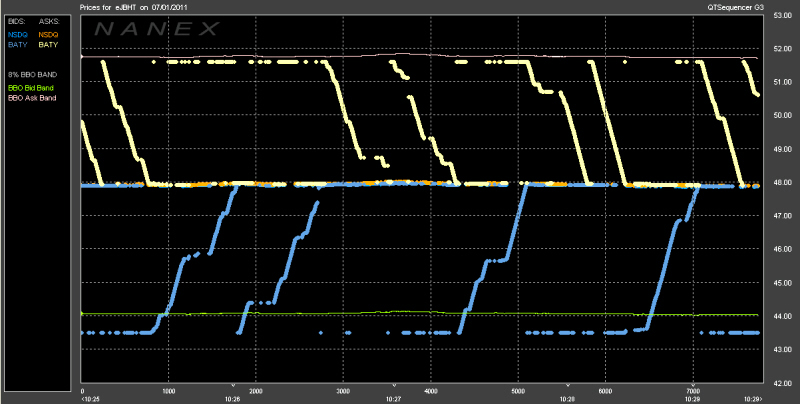

Symbol JBHT - 5 second glimpse of the algo on 07/01/2011 (click on chart for a

high resolution image).

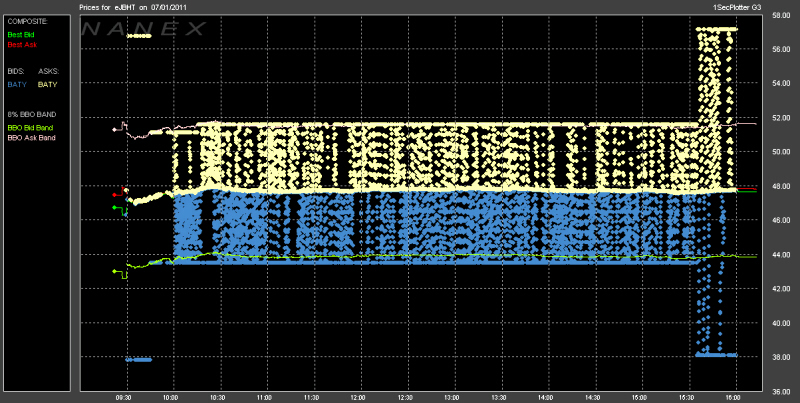

Symbol JBHT - The entire trading day of 07/01/2011 (click on chart for a high

resolution image).

What we know about the algo to date:

- The algo runs in highly liquid issues. There appears to be no particular

class of stock, we have seen the algo in dozens (a conservative estimate) of

individual issues.

- The algo consistently quotes prices that rise and fall from the outer BBO

distance thresholds to the current price levels. The distance thresholds are

not computed in real-time but are adjusted periodically, or when the timeframe

requires a threshold change (see Part 2).

- We have seen excessively high quote rates from this algo. Millions of

non-sense quotes over the course of a day.

- The algo runs non-stop, all day long on the selected issues.

- The algo quotes almost exclusively from the BATY exchange. This is not to

imply the BATY exchange is responsible for the algo, only that whoever is

making these orders is doing so through the BATY exchange. We have seen minor

instances of the algo running on the BATS exchange but they are very rare.

- After reviewing data from historical tapes, the first day we see this algo

appear is June 20'th, 2011, although running at much lower frequencies than

June 28'th, 2010 when first spotted in our algo monitors. As of this writing

(July 11'th, 2011) the algo has run every trading day since. It runs on dozens

of issues each trading day.

The following pages provide a detailed analysis of the algo and it's behavior:

Click here

to see the SEC rules prohibiting Market Maker stub quotes which went into

effect in December 2010.

Click

here

to see stocks in the Russell 1000.

|

Inquiries: pr@nanex.net

Publication Date: 07/11/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|