Legal Limit Algo - Part 2, The algo is aware of the

limits/timeframes.

|

Back to Legal Limit Algo Contents

According to this, the new

stub quoting rule (which went into effect in December 2010) states that:

- For securities subject to the circuit breaker pilot program approved this

past summer, market makers must enter quotes that are not more than 8% away

from the NBBO.

- For the periods near the opening and closing where the circuit breakers

are not applicable, that is before 9:45 a.m. and after 3:35 p.m., market makers

in these securities must enter quotes no further than 20% away from the NBBO.

- For exchange-listed equities that are not included in the circuit breaker

pilot program, market makers must enter quotes that are no more than 30% away

from the NBBO.

- In each of these cases, a market maker's quote will be allowed to

"drift" an additional 1.5% away from the NBBO before a new quote

within the applicable band must be entered.

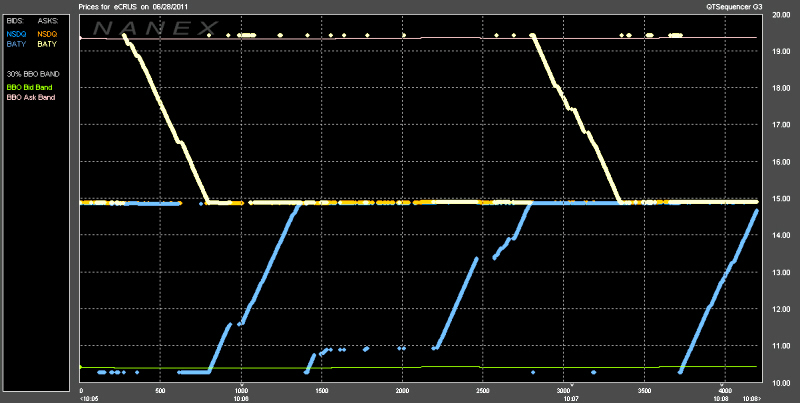

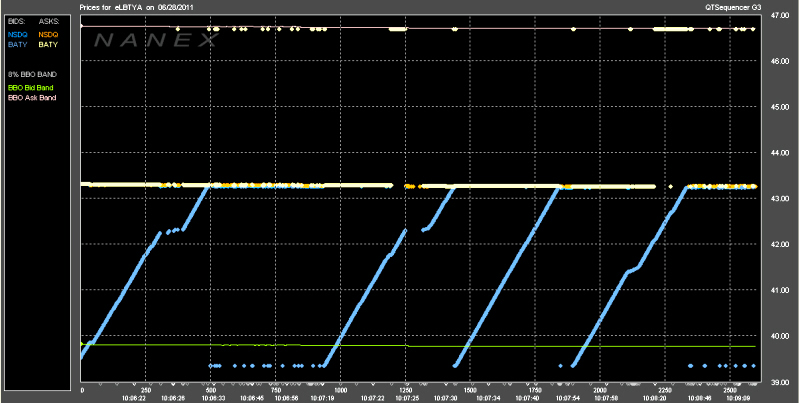

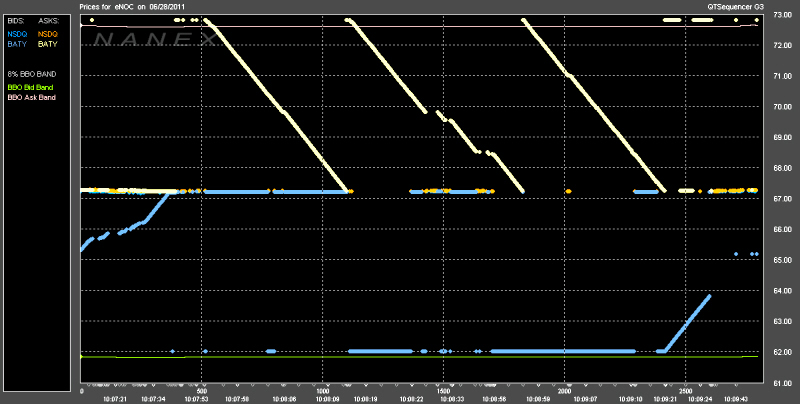

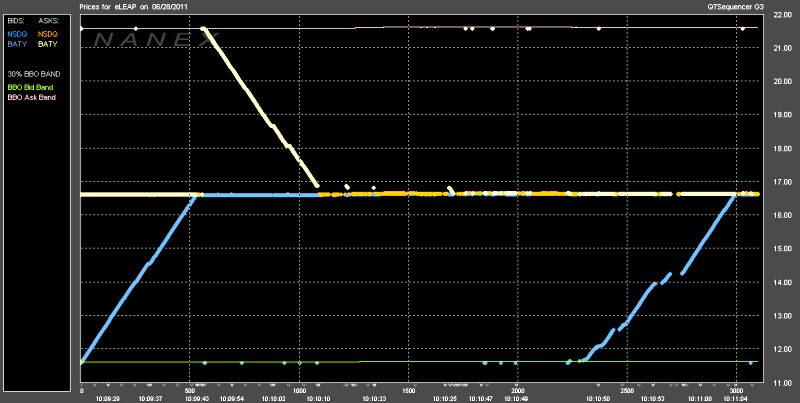

As you can see from the following charts, the Legal Limit algo is keenly aware

of the stock it is running in and the legal quoting limits. It runs within the

appropriate banding limit for each stock and will quote both the bid and ask up

and down sequentially from the outer threshold to the current price range, then

returning to the outer threshold to start the sequence over.

In the following charts quotes are plotted sequentially as they occur. As

such, no data is lost. Exchange's bid and ask prices are colored according to

the legend on the left. To keep the charts clearer we have filtered out trades

and quotes from exchanges not shown. Quotes from the NSDQ exchange are

plotted only as a reference. Click on any chart for a high resolution

image.

Symbol CRUS, CIRRUS LOGIC.

CRUS is not in the Russell 1000, not subject to the circuit breaker pilot

program and therefore quotes must be within 30% of the BBO.

Symbol LBTYA, LIBERTY GLOBAL.

LBTYA is in the Russell 1000, subject to the circuit breaker pilot program and

therefore quotes must be within 8% of the BBO.

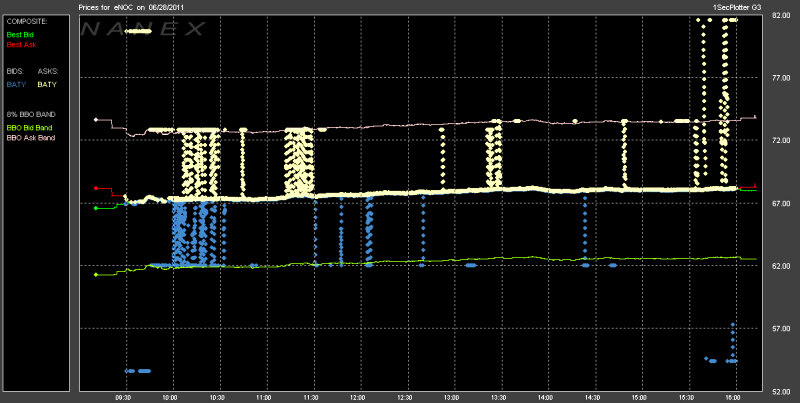

Symbol NOC, NORTHROP GRUMMAN.

NOC is in the Russell 1000, subject to the circuit breaker pilot program and

therefore quotes must be within 8% of the BBO.

Symbol LEAP, LEAP WIRELESS.

LEAP is not in the Russell 1000, not subject to the circuit breaker pilot

program and therefore quotes must be within 30% of the BBO.

The algo is also aware that the 8% BBO distance threshold on stocks in the

Russell 1000 (and the circuit breaker pilot program) is only applicable from

9:45 AM EST to 3:35 PM EST and when outside of this timeframe the amount

increases to 20%.

In the following chart we again look at the stock NOC, this time on a one

second chart for the entire trading day. Note that from 9:30 - 9:45 AM the algo

was quoting at 20% away from the BBO but at 9:45 AM it quickly tightens to the

8% band, as required. Furthermore at 3:35 PM EST the algo immediately resumes

quoting outside of the 8% limit.

Symbol NOC, NORTHROP GRUMMAN.

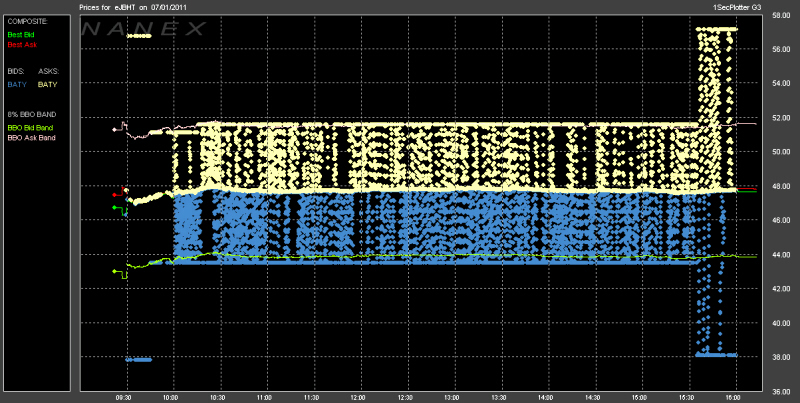

The same behavior is seen in JBHT, another stock in the Russell 1000:

Symbol JBHT, JB HUNT TRANS.

|

Inquiries: pr@nanex.net

Publication Date: 07/11/2011

http://www.nanex.net

| This report and all material shown on this

website is published by Nanex, LLC and may not be reproduced, disseminated, or

distributed, in part or in whole, by any means, outside of the recipient's

organization without express written authorization from Nanex. It is a

violation of federal copyright law to reproduce all or part of this publication

or its contents by any means. This material does not constitute a solicitation

for the purchase or sale of any securities or investments. The opinions

expressed herein are based on publicly available information and are considered

reliable. However, Nanex makes NO WARRANTIES OR REPRESENTATIONS OF ANY SORT

with respect to this report. Any person using this material does so solely at

their own risk and Nanex and/or its employees shall be under no liability

whatsoever in any respect thereof. |

|

|

|