The Emperor Has No Clothes

Even HFT Proponents are Clueless about

Spreads

More

Nanex Research

Updated 3/2/2012: We created an animated GIF showing the growth (2006 -

2012) of the

NBBO Spread Ignition Events

shown in two charts at the bottom of this page.

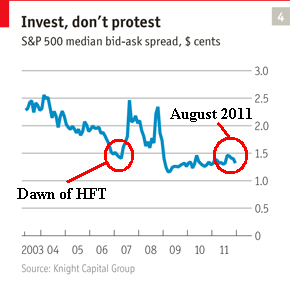

Occasionally a new study comes out claiming HFT narrows spreads.

There are a number of questions you need to ask about these claims, such as how recent

is the data set, what is the resolution (1 second, minute or daily), how are spreads measured, and what subset of symbols were

used in the study? For example, this article

from

The Economist uses the following graphic supplied by a pro-HFT camp which purports

to show tighter

bid/ask spreads. Never mind the obscure explanation (or lack of) for how this one

line is calculated, you simply need to look at the dates to realize someone doesn't know

their history very well. HFT trading was born with Reg NMS in early 2007 (left circle, as we define HFT),

and shortly thereafter, spreads actually spike higher. Furthermore, spreads

are right back to where they started (right circle), but we are stuck with all

the negative HFT baggage. Remember, this image was supplied by the pro-HFT camp!

The chart below on the left illustrates one aspect of just how difficult measuring quote spreads can be. It shows the number of stocks with increasing (red) and decreasing (black) spreads

for each second for about 1 minute on February 27, 2012 around the time that market

traffic exploded with active ETFs such as SPY, IWM, QQQ, etc. experiencing

locked or crossed

markets.

Note how the red line spikes suddenly at 12:50:41, indicating almost 1,600 stocks had

increasing spreads. The very next second, the red line drops, and the black line spikes

indicating approximately 1,100 had decreasing spreads. This repeats again just 8 seconds

later. Note how every red spike is immediately followed by a black spike, and in most

cases, the red spike is higher and narrower than the black spike. This indicates the

highly volatile nature of quote spreads: where the bid/ask spread of 1,000 or more

stocks stocks can suddenly increase within a second.

The chart on the right is a randomly selected chart with a similar surge in market

activity on a day before Reg NMS (and HFT). Note the scale difference: many fewer

stocks had volatile spreads. The chart on the right is typical of spread behavior

before HFT.

See also Quote Spread Disintegration.

| February 27, 2012 |

January 25, 2007 |

More Nanex Research