| Start Time |

End Time |

Elapsed Time |

Event |

| 11:00:00 |

11:05 |

5 minutes |

Trading to begin (postponed to 11:05) |

| 11:05:00 |

11:10 |

5 minutes |

Trading to begin - 2nd attempt (postponed to 11:10) |

| 11:10:00 |

11:30 |

20 minutes |

Trading to begin - 3rd attempt (postponed to 11:30) |

| 11:10 |

11:45 |

35 minutes |

Erratic prices appear

in Apple, Netflix and at least 24 other

stocks over next 45 minutes. |

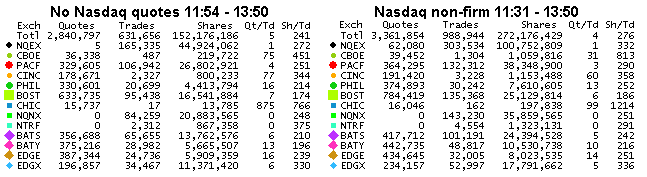

| 11:29:52 |

11:30:09 |

17 seconds |

Nasdaq goes radio silent

for all stocks for 17 seconds |

| 11:30:09 |

|

|

Trades from BATS and NQ-Bost appear |

| 11:30:10 |

|

|

Trades from Nasdaq appear |

| 11:30:34 - |

13:50 |

3 hours, 20 mins |

Nasdaq Bid gets stuck at 42.99. SIP users no longer see NBBO

eligible Nq Quote until 13:50 |

| 11:30:34 |

11:54:20 |

~ 20 minutes |

Nasdaq Ask is non-firm (not eligible to set NBBO) |

| 11:50:06 |

|

|

Nasdaq Ask gets stuck at 38.01 -- stops updating when other

exchange quotes move higher |

| 11:54:17 |

13:50 |

~ 2 hours |

Nasdaq

Ask remains stuck at 38.01, and stops updating until 13:50 (Other exchange quote prices moved higher) |

| 13:50:01 |

13:50:03 |

3 seconds |

Approx 37,000 quotes and 22,000 trades are blasted over 3 seconds

from all reporting exchanges, causing several full second outages. |