SEC Fines NYSE

Today, a watershed event happened vindicating the research that Nanex and Themis Trading have been touting for years!

"This marks the first-ever SEC financial penalty against an exchange." - SEC

http://sec.gov/news/press/2012/2012-189.htm

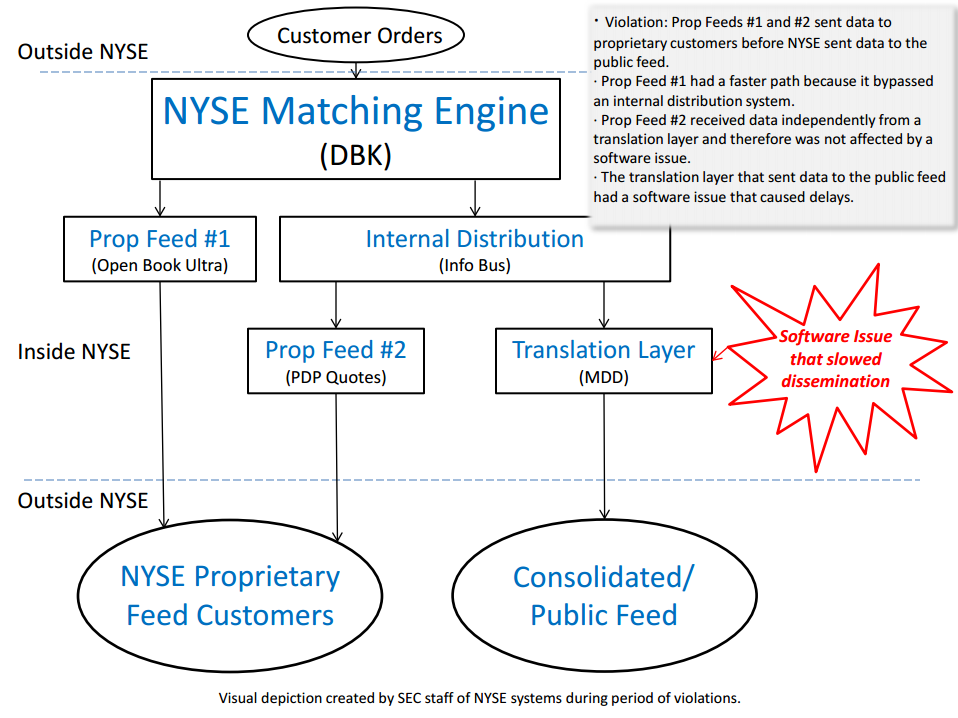

It all boils down to the diagram below, which is the SEC's depiction of NSYE's internal network during the periods of violation:

*Image taken from the original PDF located on the SEC website: Original SEC PDF

The filing mentions rule 603(a) of Regulation NMS:

-

First, Rule 603(a)(1) requires that any market information distributed by an exclusive processor, or by a broker or dealer (including ATSs and market makers) that is the exclusive source of the information, be made available to securities information processors on terms that are fair and reasonable.

-

Rule 603(a)(2) requires that any SRO, broker, or dealer that distributes market information must do so on terms that are not unreasonably discriminatory. These requirements prohibit, for example, a market from making its "core data" (i.e., data that it is required to provide to a Network processor) available to vendors on a more timely basis than it makes available the core data to a Network processor.

Nanex ahead of the curve since August 23rd, 2010.

While investigating the Flash Crash, Nanex reported on speed differences between the quotes coming from CQS (Consolidated Quotation System), or the public data feed, and Openbook (NYSE proprietary data feed). During this study, we found a very strong correlation between the quote rate and the delay between CQS and Openbook.

At the time we noticed that a quote rate of 20,000/second was enough to show a marked delay to the public feed.

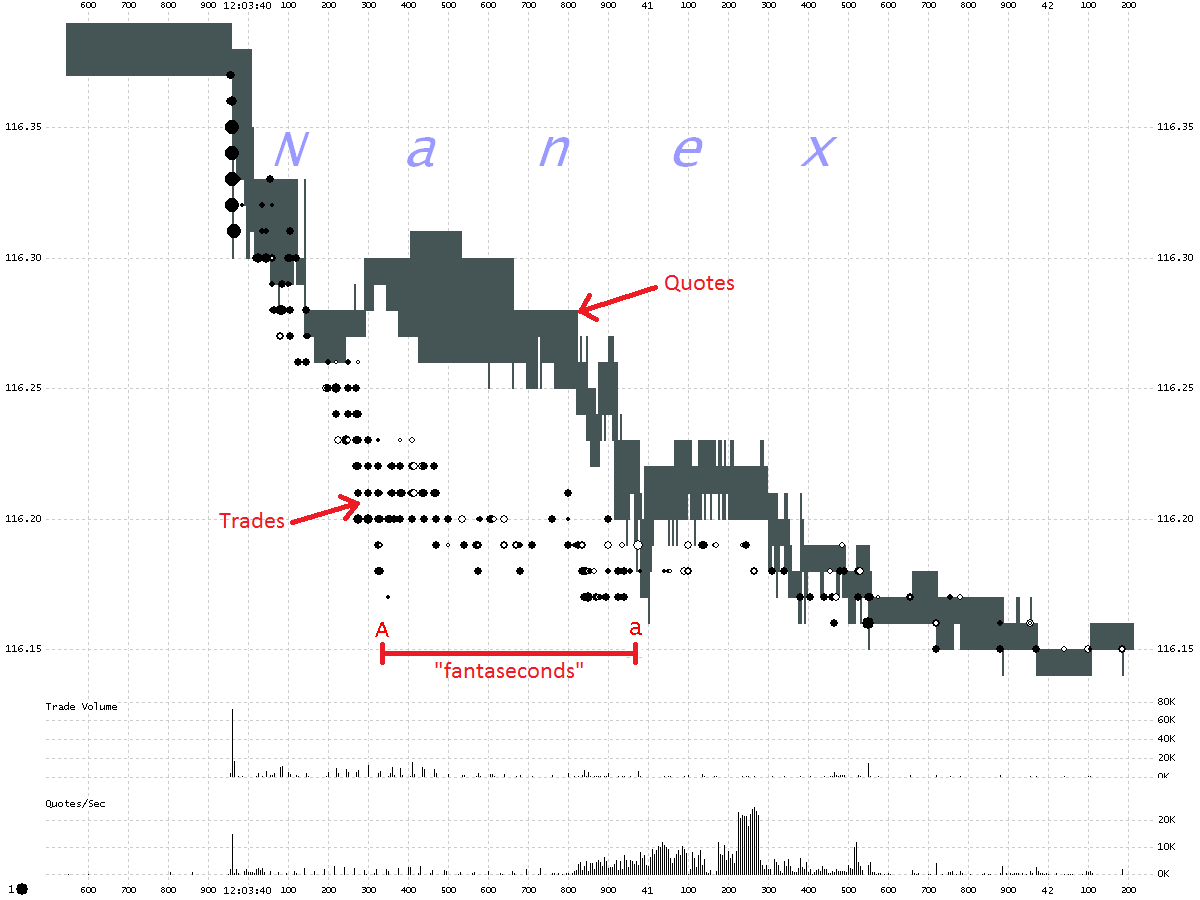

Since then, we have seen occurrences of what we coined as "fantaseconds" or a period of time between trades being reported and the quotes those trades were based on being reported. When the delay occurs, trades will be time stamped before the quotes coming through CQS. This is precisely what happens when this delay occurs.

Below is a 5 millisecond interval chart of SPY showing Nasdaq trades (circles) and quotes (shaded vertical lines). The distance between the points labeled A and a is the minimum time that trades came ahead of quotes.

*Image taken from Nanex article: Reg NMS Has Been Rescinded

*NOTE* The image above actually shows Nasdaq and not NYSE. It is used because it shows an obvious instance where the quotes lag the trades resulting in "fantaseconds".

We have been noticing marked difference in the overall market compared to last year. Could the SEC's investigation into issues like this be the reason market participants are behaving themselves?

It's good to see that at the end of the day, all the time and effort that Nanex and others who are vocal about market abnormalities is starting to bear fruit.

Kudos to the SEC

We here at Nanex applaud the SEC on this action and are looking forward to see how they shed some light on the order routing that happens in our ever increasing complex system known as the public market shown here in all of its glory:

This video shows about 5 seconds of time for trades occuring in MasterCard on May 16, 2012. It is a visualization of the communication between the public exchanges and the SIP (Securities Information Processor).