A study of 41 billion trade reports since 2006 reveals a clear winner from retail price improvement. Hint: it's not the retail trader.

Salami Slicing from Wikipedia:

Salami slicing is a series of many minor actions, often performed by clandestine means, that together results in a larger action that would be difficult or illegal to perform at once. The term is typically used pejoratively.

An example of salami slicing, also known as penny shaving, is the fraudulent practice of stealing money repeatedly in extremely small quantities, usually by taking advantage of rounding to the nearest cent (or other monetary unit) in financial transactions.

We counted all eligible trade reports from stocks listed on NYSE, ARCA, AMEX, and Nasdaq from January 3, 2006 through July 25, 2012. To be eligible, the trade price had to be greater than $2. To qualify as a sub-penny trade in this study, the price had to require more than 2 decimal places, and not be priced exactly at 1/2 cents.

See this report for more information on sub-penny trades, who benefits, who loses, and what the SEC has stated and ruled on this important topic. We also published a paper on sub-penny trades in Apple stock.

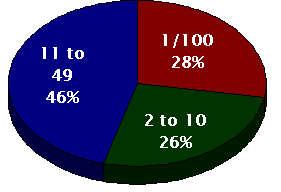

The pie chart below shows the distribution of the sub-penny trades in our study. A full 28% (red slice) of these trades had a price improvement at the lowest permissible amount: 1/100th of a cent ($0.0001) per share.

The total price improvement on a typical $10,000 stock trade is a whopping 1 penny. Who in their right mind would think this was a benefit worth touting?

The other slices show that 26% (green) of sub-penny trades had a price improvement benefit between 2/100 and 10/100ths of a cent, and 46% (blue) had a benefit between 11/100 and 49/100 of a cent.

In the SEC's own words:

[Reg NMS] was designed to limit the ability of a market participant to gain execution priority over a competing limit order by stepping ahead by an economically insignificant amount.

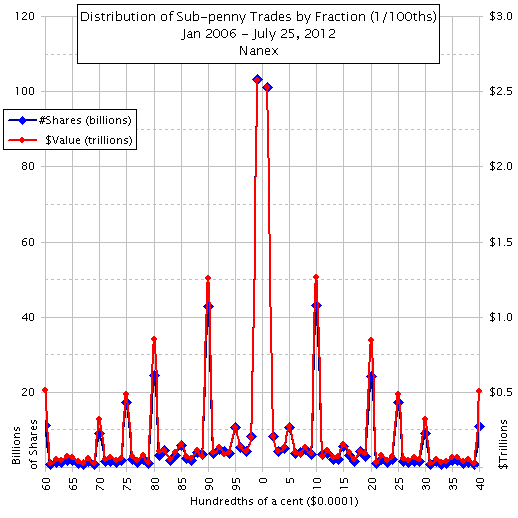

The next chart further details the distribution of sub-penny trades. The two spikes in the center represent prices with fractions of a cent of 99/100 and 1/100 -- both of which are 1/100 of a cent away from the nearest whole cent. The sum of these two spikes make up the red slice in the pie chart above.

Note how the data in the left half of the chart is a near mirror image of the data on the right half of the chart. That is because internalizers (wholesalers, those who buy orderflow from retail brokers) give buyers the same price improvement they give sellers. Also note that the left scale is in billions of shares, and the right scale is in trillions (yes, trillions) of dollars.