Nanex ~ 30-Jul-2012 ~ Bad Apples in AAPL

On July 24, 2012, at 09:31:28 Eastern time, a 100 share trade of AAPL crossed the tape at a price of 609.1499 for a transaction value of $60,914.99. At the time of the trade, the national best bid/offer (NBBO) was 609.00 bid and 609.15 offer. This indicates an investor (Investor A) bought AAPL for $0.0001 (1/100th cent) less than the prevailing offer of 609.15:

a total savings of 1 penny on a $60,915 transaction. This is called price improvement.

Now there's nothing wrong with giving Investor A an extra penny on a $60K trade, especially when they didn't have to ask for it. But what about the sell order at 609.15 that wasn't filled? That was likely an order placed by another investor (Investor B) wanting to sell AAPL, and would have sold their stock if someone hadn't cut in front of them by a fraction of a cent, leaving their order high and dry. Now Investor B could just wait for another buyer to appear, but there is a chance another buyer won't materialize (and over the next 4 days, a buyer never did). Now, Investor B could sell their stock immediately (and therefore be in the same position as if their order wasn't cut in front of) by selling at the prevailing bid price of 609.00. Which means accepting $60,900 for their stock instead of $60,915. In other words, the cost to Investor B for being cut in front of was $15.

So Investor A gained $0.01 and Investor B lost $15, which means whoever jumped in front of Investor B's order received an economic benefit of $14.99.

In this example, Investor B would have had to immediately react and sell their stock at the prevailing bid because within the next second the price of AAPL began to plummet, dropping $1 over the next minute. If Investor B simply waited for another buyer at their price, they would still be waiting 4 days later. And they would have seen the value of their stock decline as low as $57,000 after the earnings announcement.

Here's what the SEC has to say about this so-called price improvement in Reg NMS:

The proposed rule was designed to limit the ability of a market participant to gain execution priority over a competing limit order by stepping ahead by an economically insignificant amount.We think 1 penny is an economically insignificant amount on a $60K transaction.

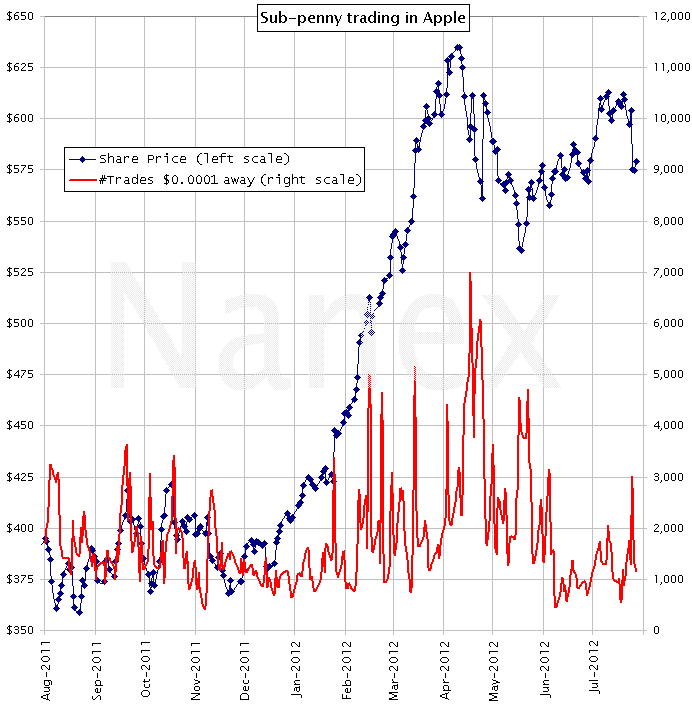

So, how often does this sort of thing happen in Apple? We analyzed data for the last year and counted all trades in AAPL with a price 1/100th of a cent away from the next whole price. We found that about 2,000 of these price improvement trades occur every trading day. Below is a plot of the last year showing for each day, the number of trades executing 1/100th of a cent away from the next whole cent (red) along with the price of AAPL stock in blue.

Since 2006, there were 3.1 million trades in AAPL that executed 1/100th of a cent away from the nearest whole cent. That means the Investor A group received a total price improvement of $125,000. Assuming a 10 cent bid/ask spread, the Investor B group received $125 million less than they should have.

Since 2006, Apple investors have lost over $100 million from price improvement.

As Investor A and B often switch places, the real beneficiary of retail price improvement is whoever is allowed to jump in front of orders by a fraction of a penny.

You may also be interested in reading our recently published report showing Price Improvement data for all stocks, or this report which has more information on sub-penny trades, who benefits, who loses, and what the SEC has stated and ruled on this topic.