Nanex Research

Nanex ~ 09-Dec-2013 ~ Odd Lots

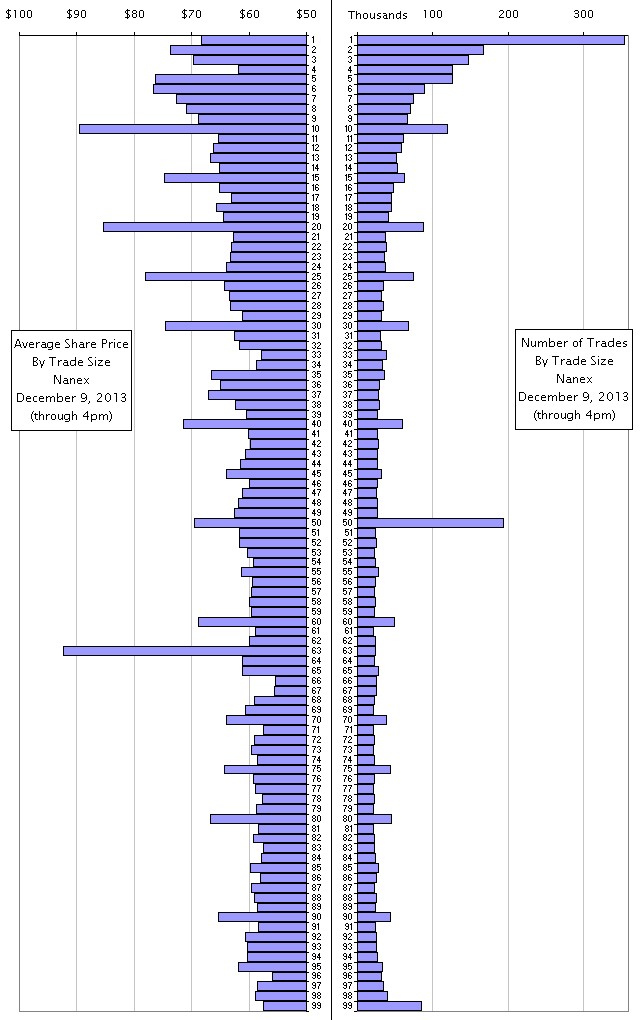

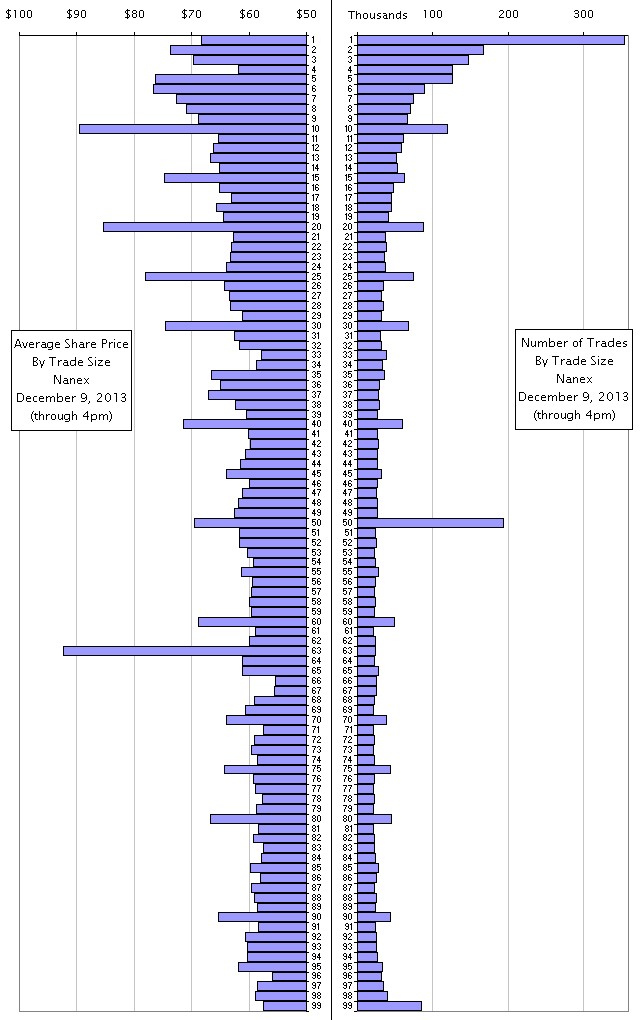

On December 9, 2013, Odd lots (trades with sizes less than 100 shares) began reporting

to the tape (Consolidated feeds). As of 4pm Eastern time, there were 4.5 million trades

with sizes less than 100 shares, which is a whopping 17.4% of all trades. Before December

9, 2013, these odd lot trades were only reported in direct feeds. The average price

of an odd lot trade in this sample was just $67 - it was expected to be a much higher

number. The charts below break down the trade counts and average price by trade size,

from 1 to 99 shares.

1. Average share price (left) and number of trades by trade size (1 to 99 shares)

from 4am to 4pm on December 9, 2013

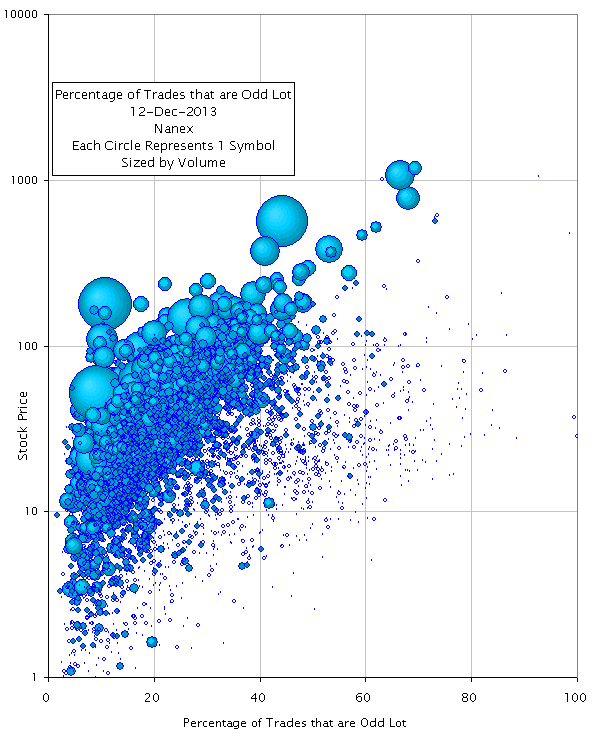

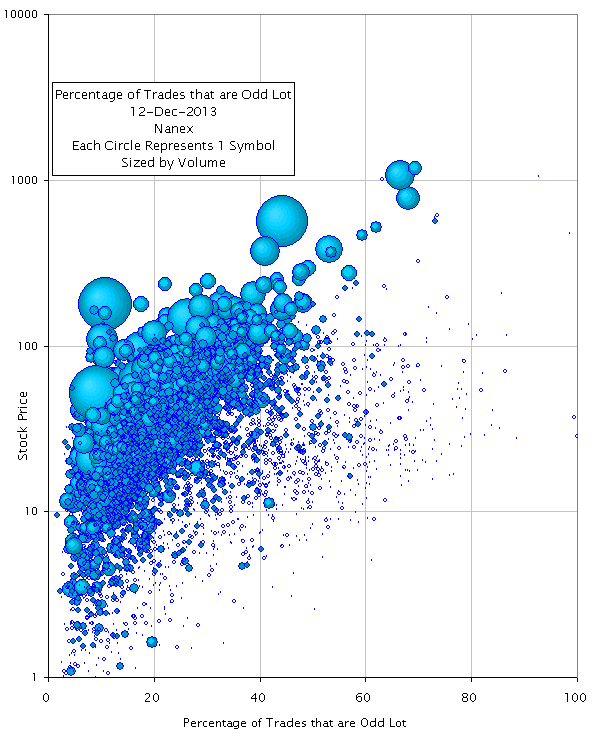

2. Distribution of Odd Lot Trades by Percent and Price.

Percentage of Trades that are Odd Lot for 7,258 NMS Stocks by Price on December

12, 2013. Each Circle is 1 symbol, sized by Trade Volume.

Note the 1 dot at 100% - here are detailed charts for that stock.

Nanex Research

Inquiries: pr@nanex.net