Nanex ~ 21-Jan-2014 ~ Flickering Quote Credits

Subversion of a key U.S. stock market regulation

Update

Read this bizarre twitter dialog between Nanex and an exchange CEO over this paper.Link to document describing SIP allocation formula. It has been confirmed to be accurate!

Synopsis

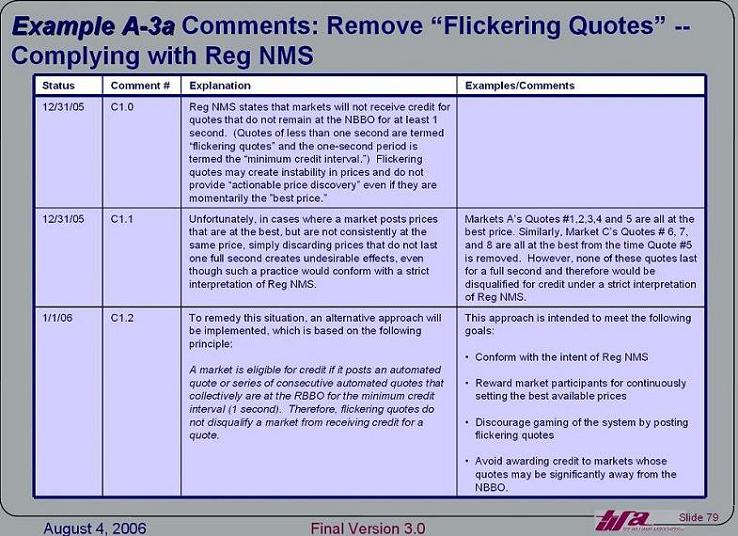

A key rule in Regulation NMS (Reg NMS, the body of rules governing the U.S. stock market) may have been subverted in the implementation process, unknown to both the public and the SEC (Securities and Exchange Commission). Had this key rule been implemented as written, exchanges favoring tactics employed by high frequency trading (HFT) would have been at a disadvantage: they would have received a smaller share of the $500 million in exchange fees collected annually from 2.5 million subscribers to real-time stock quotes. The subversion of this key rule removed an important incentive placed by the SEC and the industry to ensure investors receive reliable stock quotes.Executive Summary

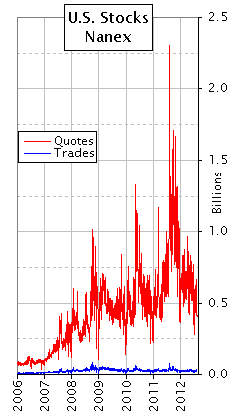

Every year, the U.S. stock exchanges together receive approximately $500 million for providing real-time stock quotes to subscribers of the SIP (consolidated market data). The portion of this $500 million pie that each exchange receives is determined by the number of trades executed and quote credits earned using a strict set of rules specified in Regulation NMS (Reg NMS). Quote credits are earned when an exchange's quote is at the NBBO (National Best Bid/Offer) for at least 1 second. Quotes that change in less than 1 second are called flickering quotes. Flickering quotes are specifically excluded from earning quote credits because they are detrimental to the market (high frequency traders use flickering quotes to probe the market or to trick other algorithms and humans).

If this sounds a lot like gerrymandering, it is, except we can't find any public record of this process. The date of this document predates the final ruling of Reg NMS, and Reg NMS has no language offering clues of its presence: it doesn't appear that the SEC was aware of this RBBO/flickering quote scheme.

A recent letter from SIFMA to the SEC requesting an audit on sub-second (flickering) quotes provides additional evidence of this rule subversion:

.. In addition, the SEC should request an independent financial audit of SIP finances and, in particular, the implementation of the market data revenue distribution formula. This audit should include an analysis of how the revenue formula is accounting for sub-second quotes in the formula and how sub-second quotes are being provided to SIP by Plan participants vs. how they appear in direct feeds. All of these audit results should be made publicly available.

The acknowledgements section of An Introduction to Trading in the Financial Markets: Technology: Systems, Data and Networks by R. Tee Williams (of Tee Williams Associates) mentions the work of the aforementioned document, along with the names of those who worked on it.

Finally, among the many detailed rebate and fee schedules from the 14 different exchanges, we can't find any fee that specifically discourages flickering quotes. In fact, the word flickering doesn't appear even once. That seems highly unlikely, given that flickering quotes play a prominent role in a calculation involving hundreds of millions in annual profits.

Those of you who know all about flickering quotes may wish to skip straight to the discussion of this troubling document.

What are flickering quotes?

Flickering quotes are quotes that last for less than 1 second, making them inaccessible to millions of traders and investors who have elected not to spend tens of thousands per month in co-location costs for timely stock prices. Many of these flickering quotes are also inaccessible to people who collectively pay hundreds of millions of dollars for real-time data, but receive that data outside of the exchange data center in New Jersey. Flickering quotes are quite common - they are a hallmark of High Frequency Trading (HFT) - so examples are plentiful.The charts below show what flickering quotes look like. The gray shading is the NBBO spread (best bid, lowest offer from all exchanges quoting this stock). The triangles show the best bid or ask price and are color coded by the exchange that submitted the quote. Best Bids use triangles pointing up, Best Asks use triangles pointing down. Each chart shows about 15 seconds of time on January 16, 2014.

1. Agilent Technologies, Inc (Symbol: A, market cap: $20 Billion).

The best bid flickers rapidly over a 20 cent range (60.02 to 60.22) and involves multiple exchanges. The best ask also flickers, but over a shorter range.

2. Varian Medical Systems, Inc (Symbol: VAR, market cap: $8.7 Billion)

The best ask flickers rapidly over a sliding 20 cent range and involves multiple exchanges. Several seconds have flickering best bid prices.

We've also created a number of videos showing flickering quotes.