Nanex ~ 23-Jan-2014 ~ Implausible Denial

The Fox of Wall Street

Synopsis

The CEO of a stock exchange claims he was unaware of the details of the process that determines how $500 million is split among exchanges for real-time stock quotes. The process deviates significantly from Reg NMS (the rules that govern the U.S. Stock Market) both in spirit and text of the final ruling. The final ruling came nearly a year after the process was formulated and known by exchange officials.The RBBO Process

Nanex published Flickering Quote Credits after receiving this document which details how $500 million is split annually by exchanges for real-time stock data. The document uses a new and unique term "RBBO" (revenue best bid/offer) and describes a process whereby flickering quotes become eligible for quote credits. Quote credits are a major determinant of the portion an exchange receives of the $500M pie. According to Reg NMS, flickering quotes are specifically excluded from receiving quote credits.There is not only no mention of the term RBBO in Reg NMS, Direct Edge CEO William O’Brien claims never to have heard of the term and took great pains to rebut our our article.

The Real Issue - Denial or Ignorance?

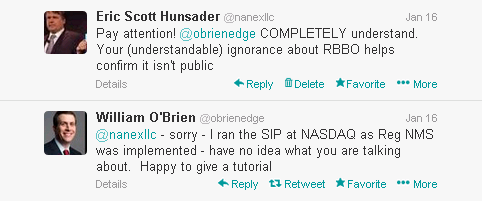

William O'Brien, tweeting as the CEO of Direct Edge, claimed he was unaware of the term RBBO:I bid my followers “pay attention” to this important discussion.

He ran the SIP during Reg NMS implementation, and was unaware of the term RBBO?

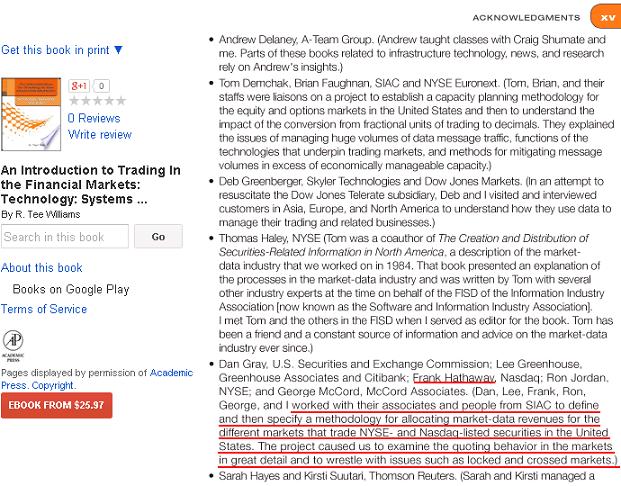

Someone who did work on the RBBO process was Frank Hatheway. Here he is named (though the surname is misspelled “Hathaway”) in the acknowledgements of a book written by the principal of Tee Williams Associates. This is the very same firm whose logo was on each page of the document describing the RBBO.

According to this SEC document, Frank Hatheway and William O'Brien were both officers at Nasdaq during the time the RBBO process was created. O'Brien said he ran the SIP at Nasdaq during Reg NMS implementation. Are we to believe these two officers never spoke about a key issue regarding the SIP and hundreds of millions of dollars in annual profits?

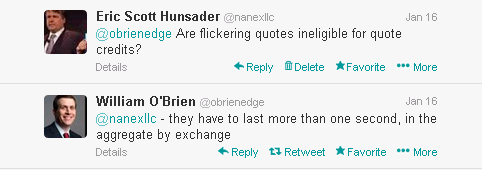

Although it's possible another term was used instead of RBBO, it's highly unlikely O'Brien was unaware of the underlying concept. I asked:

He doesn't know about the RBBO process that converts many flickering quotes to eligibility?

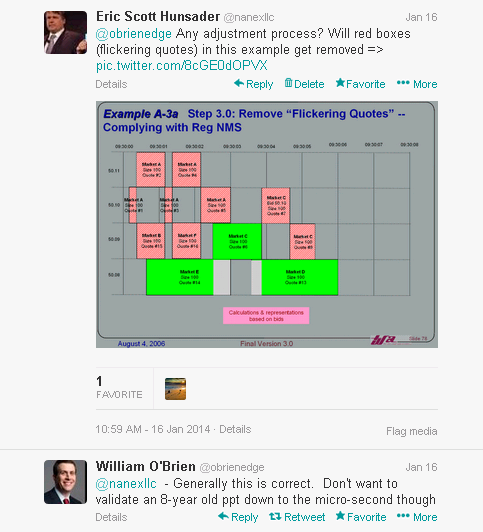

To be sure he understood the question, I posted a "before" image taken directly from the RBBO process: one his employment timeline indicates he had to have seen:

His statement "Generally this is correct" is incorrect, as can be seen in this before and after model that starts with the same image above. In the model, taken straight from the RBBO document, the red boxes (flickering quotes) are NOT removed as required by Reg NMS, but are adjusted to become eligible for quote credits.

How could the officer in charge of the SIP not know about the RBBO process?

O'Brien's Response

We'd like to thank Bill O'Brien for spending an entire afternoon writing this rebuttal. In it, he provides good insights and brings an exchange official's perspective to some of the problems the industry wrestled with during the passing of Reg NMS. Although he makes several good points that will further a constructive discussion of the problems with market fragmentation, he unfortunately glosses over the specific problems we face in our business over flickering quotes (the topic of our paper), hard evidence notwithstanding.To be sure, having read his response, we would not change a single word in our original article, and there are several statements that raise red flags.

1. His response to the charts we posted, which specifically show egregious HFT quote flickering, is simply unacceptable:

I won’t comment on the specific charts because in my opinion, while they are artistically interesting, they provide little analytical value, and there’s nothing much to say about them other than that.

[..]

As discussed above, I see no value in theses charts and thus no need to comment on them.

2. When confronted with the alarming surge in unnecessary quote traffic caused by flickering quotes, he offers a disturbing analogy:

I don’t find this alarming at all, as this is a similar trend to all aspects of modern life. While we’re at it, let’s ban Netflix because video downloads from the internet have gone up astronomically since 2005. Think of that the next time you’re catching up on Breaking Bad.A more accurate analogy: the price of Netflix goes up 10-fold, requires a gigabit internet connection, and removes HD. All because a swarm of well-funded robots are trying to artificially inflate a movie's popularity.

3. This is one of the more troubling statements he makes:

I could write a whole separate document on how that, even if you as an individual may not directly invest in trading technology, you still leverage the investments of your broker and others who do. Also go back to the SEC discussion of sophisticated broker order-routers at SEC Approval Order, pages 261-262. Quotes lasting less than a second are easily accessible within the framework of connectivity and technology that make up modern markets.It appears he's saying the retail investor should “trust us”; we'll take care of the mechanics to ensure you get the best execution. But re-intermediating industry between the investor and the markets is inconsistent with fundamental market principles. And we've seen the results: traders and investors contact Nanex almost every day with evidence to the contrary, and our data, which he dismisses out of hand, corroborates their concerns.

4. He affirms he held key positions both prior to Reg NMS when the RBBO process was created, and later during the implementation of Reg NMS:

These comments are based on my own personal experiences (as general counsel and later chief operations officer at an ECN as Reg NMS was debated, and at NASDAQ as senior vice president of Market Data which involved operating the SIP as Reg NMS began to be implemented)

5. Beyond simply disavowing knowledge of the RBBO, O’Brien actively accuses Nanex of fabricating a term that is defined on an official document confirmed by multiple sources:

Nanex makes the term “RBBO” into some term that has meaning when it is simply made up.

[..]

As discussed earlier, some of these concepts and terms are just plain made up. See earlier explanations.

6. There are several examples where O’Brien contradicts himself. Here he first denies, then confirms that the term “flickering quote” is used in the SEC Approval Order.

Regulation NMS itself never includes or defines the term “flickering quote”. See the actual text of Reg NMS as approved by the SEC (“SEC Approval Order”), pages 434-523.

[the very next paragraph]

To be fair, the term “flickering quote” is used extensively in the SEC Approval Order.

7. The PowerPoint he refers to below is complete, given to us by two separate sources, and the chair of the committee that created it confirmed that the process in the document IS actually how the formula was and still is implemented.

Some of the Plans hired consultants to help manage through all the issues with implementation. This PowerPoint is a document from one of those consultants. Nanex doesn’t provide the whole document, but it should be clear that: (i) it is the description of the issues as seen by a private party, and not an official document of any exchange; (ii) there is no evidence of any exchange guiding this document’s creation much less agreeing with the content; (iii) it is not part of any SEC-approved process of Plan administration (see description of that process below); and (iv) it was created almost two years prior to the actual Plan being updated to reflect the Reg NMS formula, suggesting it was an early attempt to provoke discussion of these issues.

8. There is no public record of the RBBO processes that we could find. It's not surprising that O'Brien failed to provide the evidence.

If you want to see the public record of this process, look for example at how it works, look at the UTP Plan, Exhibit I, Section 4. These plan documents have to be filed with the SEC every time that they change. For this change in particular, the change was specifically described as being “updated to reflect the Regulation NMS revenue formula” page 4. I think there is a discussion to be had as to whether this could be more descriptive, but the public record does in fact exist. I don’t know why Nanex couldn’t find these documents.

9. O’Brien has already legitimized our concerns by spending an afternoon and seventeen pages. He urges the reader to have an open mind. Then he drops this gem:

I can already see Nanex blaming HFT for this practice in my mind’s eye, but I can only do so much to contradict conspiracy theories.