| Zoom 1 - ECB News Release | Zoom 2 - DAX Resumes Trading |

|

|

|

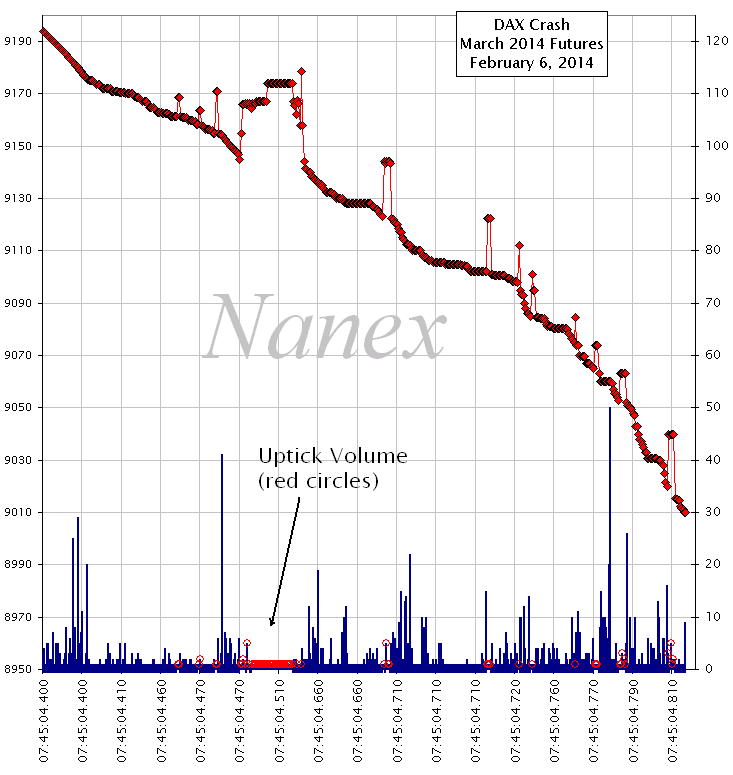

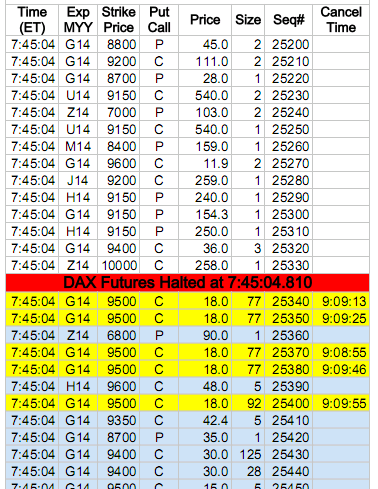

Trades in DAX Options around the time of the halt provides additional clues as to what happened.

The only DAX options trades canceled that day by the exchange (including all symbols) were DAX options

that traded right after and during the halt.

However, not all options traded during the halt were canceled. The first part of the list is shown in the image on the right (download the full list). Trades are arranged by time and sequence number. Canceled trades are highlighted in yellow and include the time they were canceled - all about an hour and 20 minutes later. The canceled trades all have large (and similar sizes). The trades highlighted in light blue executed during the halt in DAX futures. The option trades during the halt would have been very profitable (or a great loss for the other party). We didn't calculate the amount, but there is enough information to make a reasonable estimate. The length of the halt in DAX futures, a whopping 3 minutes and 51 seconds, is an exceptionally long time. |

|