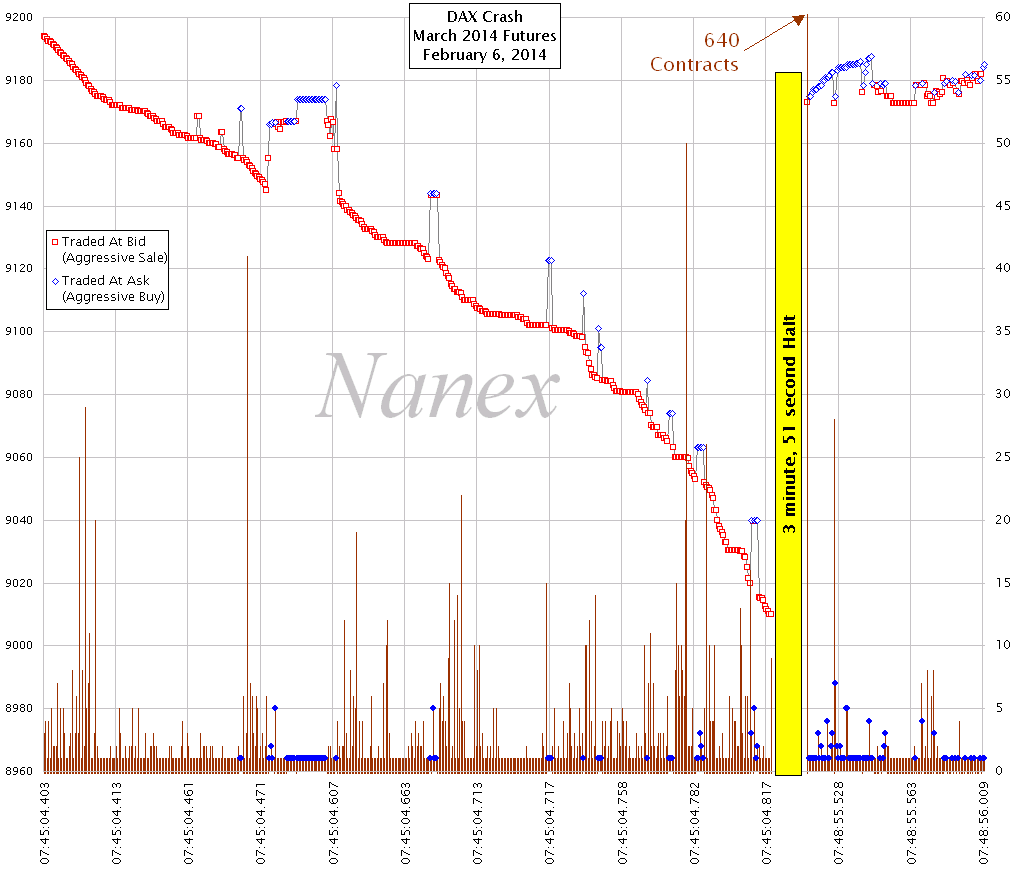

Eleven days later (February 17, 2014) Eurex published their in-depth view of the DAX crash and included a "tick chart" showing every one of the 494 trades (1,488 contracts) during the drop in the March 2014 futures contract. Almost immediately, we knew something was wrong with their tick chart: it did not represent the actual sequence of events during the crash! Worse, much of the discussion in their paper was clearly based on this erroneous view of what transpired during those alarming 400 milliseconds of time.

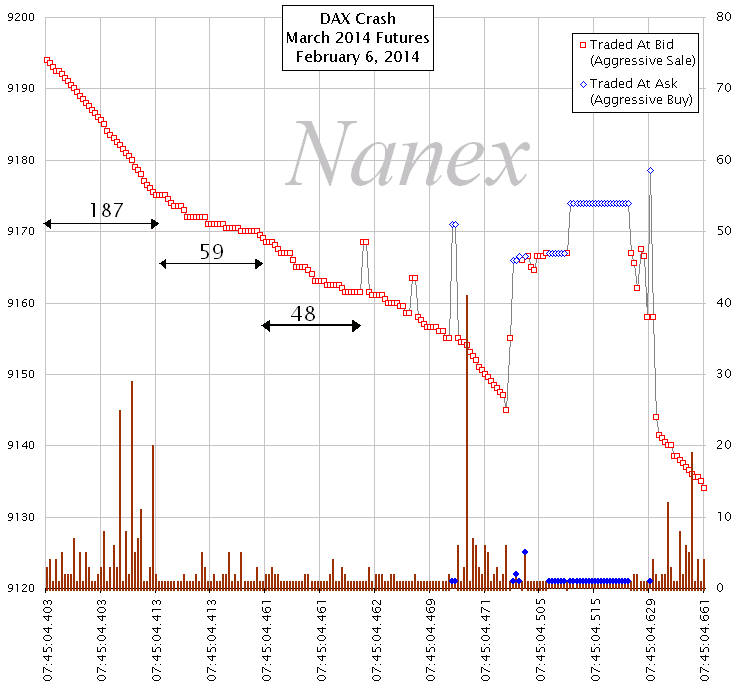

Our analysis found that there was a complete absence of liquidity due to the impending ECB news. Nonetheless, a seller of at least 187 contracts decided to hit all existing buy orders immediately, and this action dropped the price from 9194 to 9175.5 (18.5 points or 0.2%). These 187 contracts executed in 36 trades - each trade priced at or below the previous trade. Which means a tick chart will show a smooth drop of prices, which is exactly what our chart below shows.