Nanex Research

Nanex ~ 1-Apr-2014 ~ Refuting HFT Claims

1. But we provide liquidity!

Ask them to define what liquidity means. Here's the Chairman of the

FIA Europe who completely gets it wrong. Here's an email exchange

with an academic who helped write the SEC flash crash report who also, completely gets

it wrong! Yes, HFT provides liquidity, but only if we are using the term liquidity

to mean something

else.

It gets worse. RBC created a product called Thor specifically to deal with the

fact that HFT were cancelling orders at other exchanges when their market

making software learned that

a large order was in the process of executing.

This means that during the execution of a market order, HFT are able

to cancel their orders at other exchanges. That is not providing liquidity in any sense

of the word.

Micro flash crash events occur when HFT suddenly pull their orders during the execution

of large market orders. Micro flash crash events are

a new phenomenon which first appeared right after Reg NMS

when HFT began. Just a few examples:

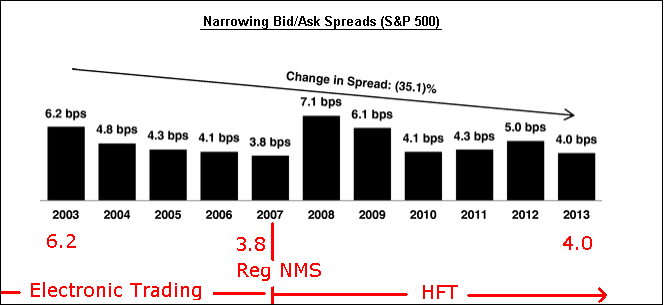

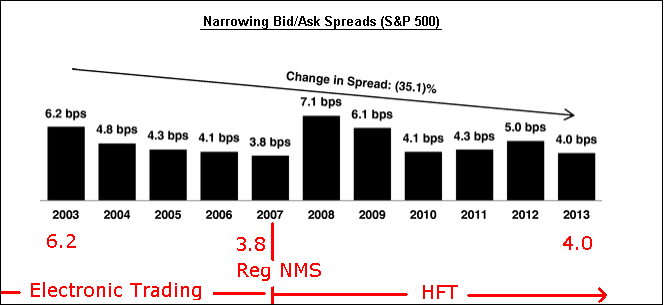

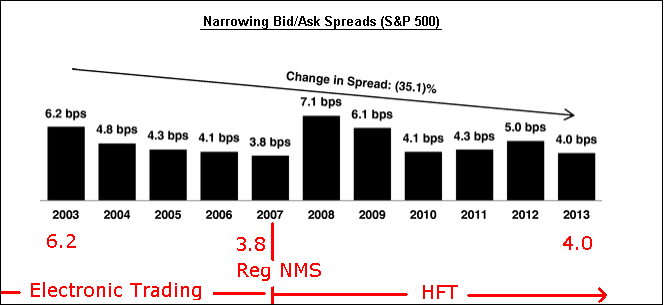

2. But we narrow spreads!

It's important to distinguish between electronic trading and HFT, one of

those lowered costs, the other lowered ethics.

Here's a chart from

a pro-HFT camp that clearly shows spreads have not narrowed from HFT. Here's another chart showing the same thing, from the

Virtu S-1 filing no less:

Just a few examples of data showing wider, or unstable spreads:

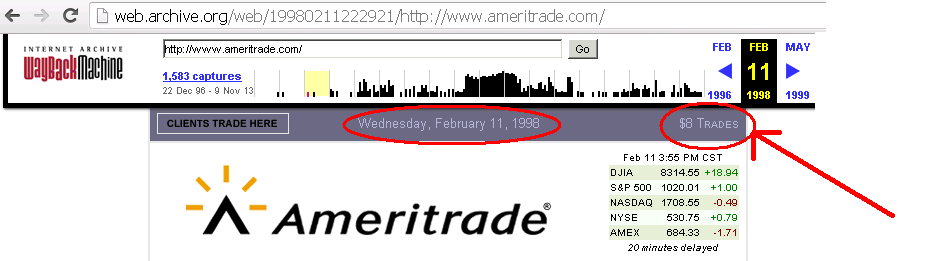

3. But we lower costs!

SEC Chairman Mary Jo White made this very misleading claim in recent speech (June 5, 2014), which we debunked here (using the same data

and source!).

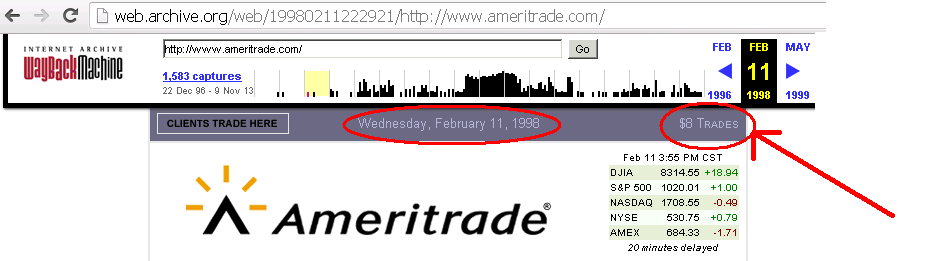

Many seem to forget that one could trade 100 shares for $8 electronically back in 1998.

Thanks to the internet way back machine, these are easy to find.

HFT proponents also never seem to mention the very real escalation in costs that HFT imposes on

everyone - which are nicely summarized here.

4. But look at all these studies that show HFT is good.

Did you know that most (if not all) of those studies never looks at data sub-second and/or outside a very select group

of stocks? Most focus on just one of 13 exchanges. And with few exceptions, are industry

sponsored.

There's plenty of academic papers, that show harm from HFT, including this one that was

published in Nature.

5. Those (insert expletive here) Nanex guys don't know what they are talking about. Why would

HFT ever want to do X?

We get this a lot, for example, when we published articles about

quote stuffing.

Here's an HFT lobbyist making that

point, and our response.

Nanex Research

Inquiries: pr@nanex.net