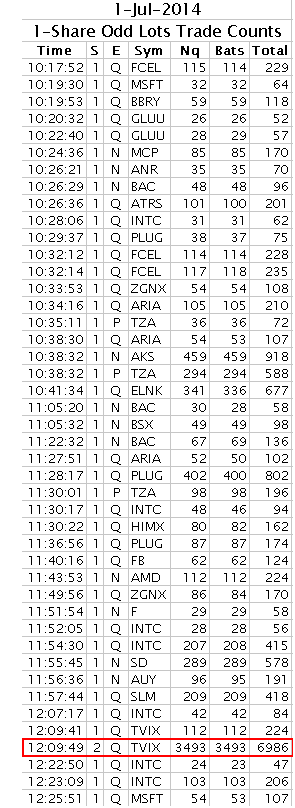

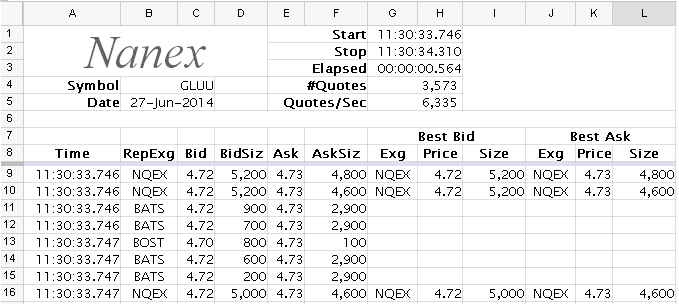

There is a new High Frequency Trading (HFT) Algo afoot, probably designed to measure, or cause system latency. This algo sends extreme bursts of 1-share orders in a symbol to two different exchanges: Nasdaq and BATS. The result is a system-impacting surge of quote updates, similar to quote stuffing, but accompanied by an extremely high number of 1-share trade executions. These trade executions often consume the entire SIP output line, as indicated by continuous sequence numbers with no gaps.

Other observations:

- The algo seems to prefer low, to very low priced stocks.

- The price executed at both Nasdaq and BATS is always the same - this isn't from arbitrage.

- The burst of trades is accompanied by a burst of quotes.

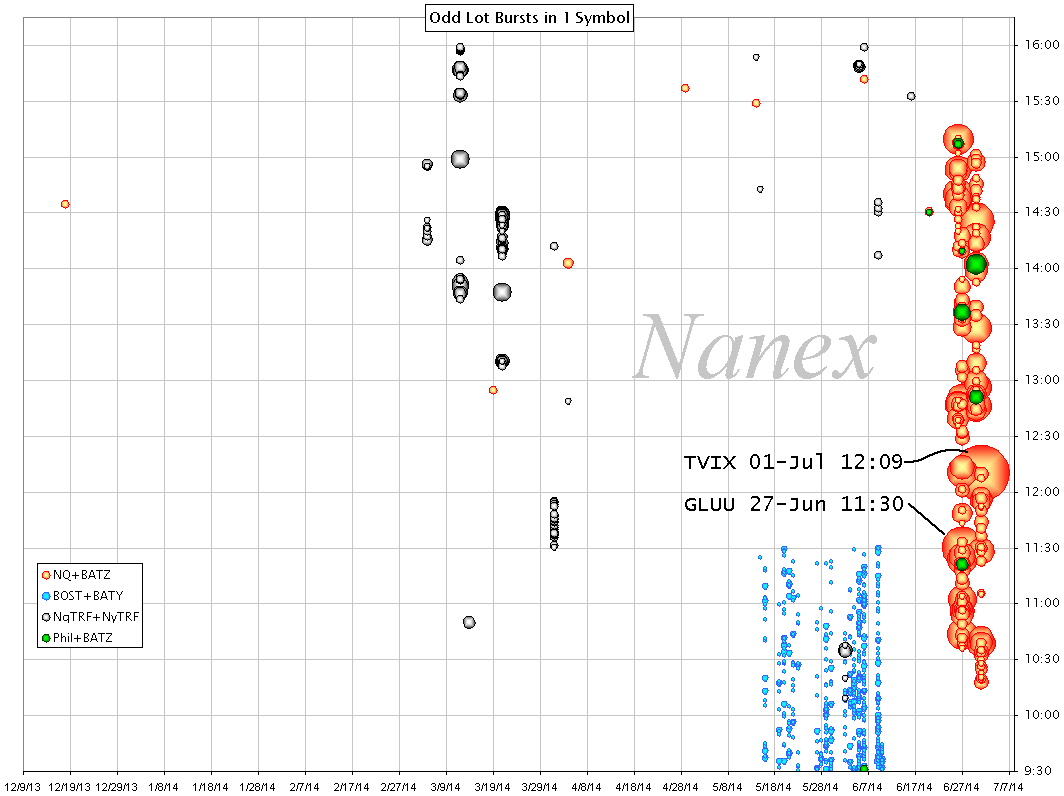

Now take a look at the graph on the left. It plots these events as colored bubbles, with each bubble sized according to the number of trades during the event. Extreme events show up as large bubbles - such as the TVIX event which is the largest bubble. The vertical axis shows the time of day, and each day's events are plotted along a vertical line. This helps to see if the algo runs at certain times of the trading day.

The bubbles are color-coded depending on which combination of exchanges are involved - in this close-up of 4 days, only one other exchange combination appeared - Phil and BATZ (green).

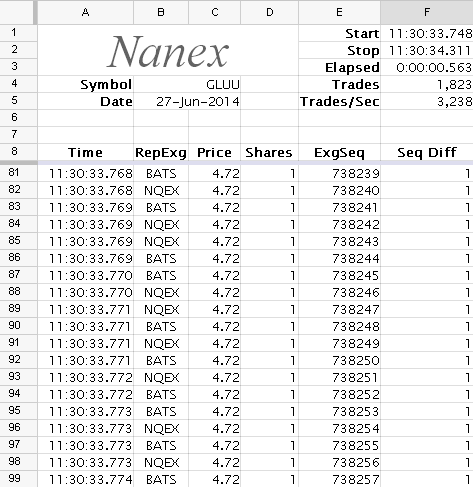

The bubble labeled GLUU was the most extreme of these events, until it was superceded by TVIX, which happened while we were writing this paper.