On July 29, 2014, Representative Scott Garrett (R-NJ), Chair of the House Financial Services Subcommittee on Capital Markets and Government-Sponsored Enterprises, held an equity market structure round-table at the Library of Congress in Washington, D.C.

The 3rd panel discussion about the SIP (Securities Information Processor) was stunning.

The SIP, commonly known as the consolidated data feed, is what most investors see when they look at a quote or stock prices when deciding whether to make an investment. In fact, 2.5 million subscribers pay about $500 million a year to exchanges for the SIP data. Imagine our shock when the very people that some have charged with rigging the market, make the claim that no one uses the SIP, and they can't find any benefit to using the SIP. These are the people running the stock market!

This is explosive material: Video of the 3rd panel discussing the SIP.

A partial list of those on the 3rd panel:

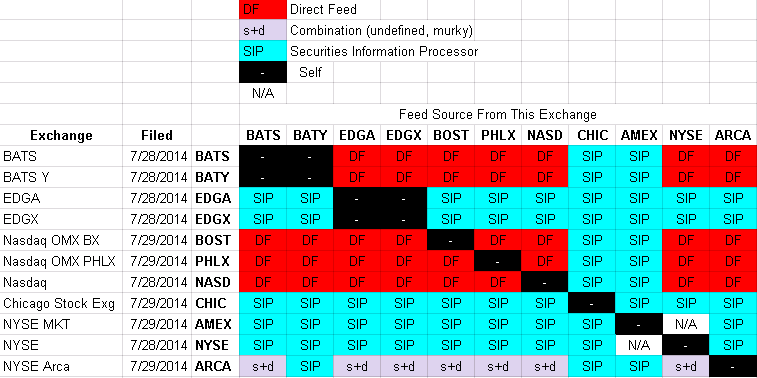

While watching the video, here's a handy matrix showing which exchanges use the SIP and which use direct feeds in their operations. If it isn't obvious, the SIP is used by every exchange partially, and by some exchanges exclusively. Note how many exchanges do not use any direct feeds (excluding their own exchange, of course). We built the matrix from exchange filings with the SEC. Unbeknownst to the panelists, this information was filed with the SEC practically at the same time they were perjuring themselves. How is that for karma?

When reading the SEC filings, you will see terms like PBBO (protected Best Bid/Offer), "Compliant BBO", and NBBO (National Best Bid/Offer). NBBO has a specific, legal definition, which states that a "plan processor" calculates the NBBO. The SIP is a plan processor. Direct feeds are not plan processors. This is a key and important distinction. Note that some exchanges and HFT often misuse the term NBBO. Here's the legal definition from Reg NMS:

To be sure, this is not the only reason people believe the market is unfair. Here are two others that we have painstakenly documented: