The article Did AutoZone Get Spoofed appeared in the Wall Street Journal on May 7, 2015. This article relies heavily on the word of Hudson River Trading (HRT), a High Frequency Trading (HFT) firm. Looking at the data presented in the article, we'd suggest that in the future, the Wall Street Journal might want to get a second opinion from data experts with a bit more experience, because it appears that HRT has simply detected NORMAL patterns that we have spotted, documented, and discussed for the past 5 years. Generally, we set our thresholds for detecting this type of "trading" at much higher levels to minimize the noise.

That said, if Hudson River Trading has identified a spoofing pattern, then it's one that happens all day, every day, in hundreds of stocks.

1. Here's Wall Street Journal Chart:

2. And here's a Nanex chart showing the same 1 minute period. Match up the labels A, B and C between the WSJ chart and the Nanex Chart. What the WSJ terms "Up and down price swings" is really just normal trading during typical wide spreads provided by HFT.

3. Zooming out further, note how the NBBO spread widens and contracts significantly. This is actually normal HFT behavior. The labels A, B, and C (on the left) show the area of interest selected by the WSJ.

4. The chart below shows what real spoofing looks like (in Apple stock) - note the time frame - chart shows only 5 seconds. More on this event here. See also this page which has links to more spoofing events we've documented.

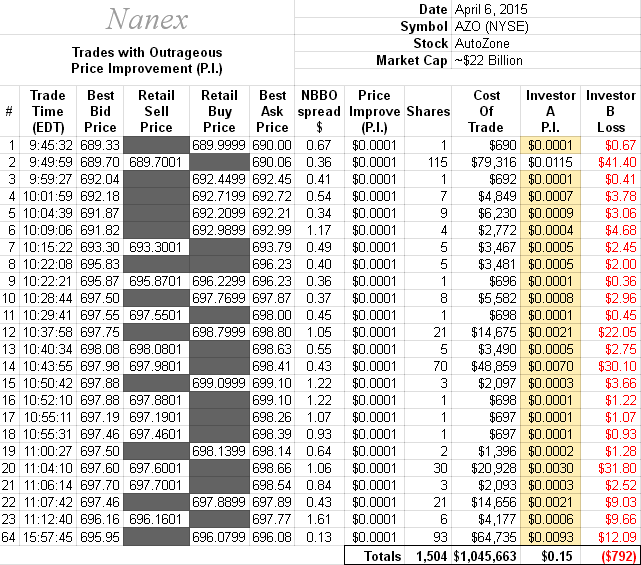

5. Back to the AutoZone example. Here's what the WSJ should have noticed - the 1 share sub-penny trade for $689.9999 (near the label C in chart 2 above) - it's drawn as a tiny green square below (note 3 points to it). This trade was the result of an internalizer filling a retail buy order. The internalizer stepped in front of the best ask price by $0.0001 - and "price-improved" the 1 share trade for 1/100th of a cent. For details on how this works, read Salami Slicing Sub-Penny Style. The table below shows other outrageous price-improved trades in AutoZone on the same day.

6.The image below shows the outrageous price-improvements in AutoZone for April 6, 2015 (this should have been the WSJ's main story). Download the PDF showing all 64 trades.

Note, out of $1 million worth of AutoZone stock "price improved" by $0.0001, retail investors (Investor A) got a bonus of 15 cents! But this 15 cent price improvement came at a cost: $792 from investor (B) whose posted limit orders were jumped in front of. The internalizer likely pocketed the difference $792 - $0.15 or $791.85.