Our recent post, Perfect Pilfering, set a record for the number of emails we received from High Frequency Traders - each writer wanting to make sure they were "talking off the record" and "please don't attribute any of this to me". One brave soul decided to publish anonymously with the intention of "debunking" our Perfect Pilfering study. What they managed to do instead (much like Virtu's response to our FOMC leak story), was confirm our findings, provide more detail into the rigging mechanism, and draw attention to just how complicated the markets have become.

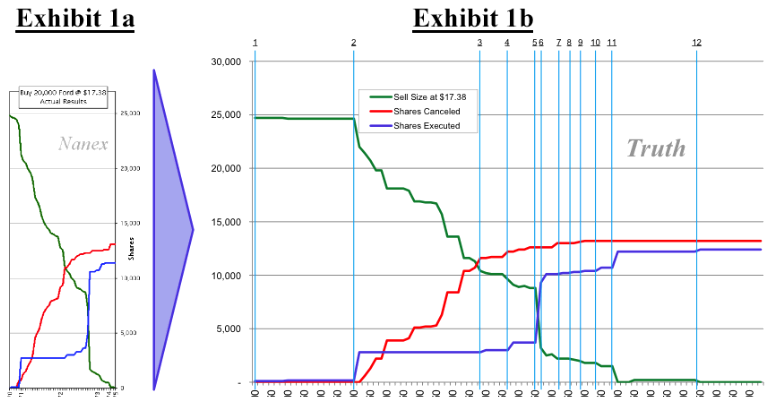

Let's start with their Exhibit 1 shown below. The chart on the left is what we published. The chart on the right (labelled "Truth") is, well, according to the Anonymous Writer (AW), the truth. We can't find any fault with their chart, it is, for all intents and purposes, a carbon copy of ours, but expanded out in time, with a few more detailed line squiggles. This exhibit, and the explanation behind it, does not change our paper one bit.

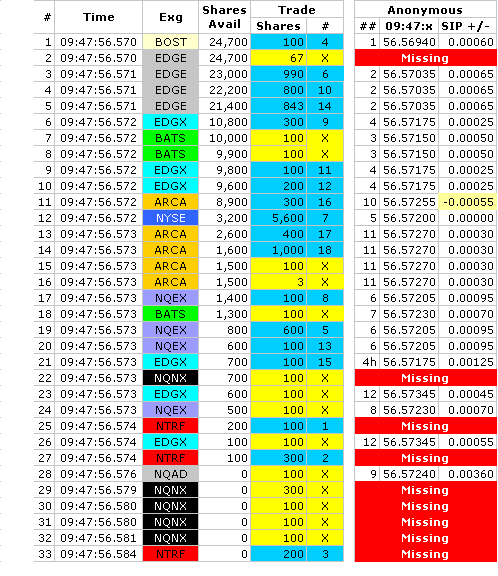

The numbered vertical lines in Exhibit 1b correspond to the underlined numeric labels in Exhibit 2 below.

There are a few missing items and points of interest we'd like to point out. First, let's line up their information along with all the trade executions for this July 11, 2014 event in Ford stock. We added 3 columns in the table below from our original paper: the first new column (##) corresponds with the underlined blue numeric label in Exhibit 2 above. The next (and last) 2 columns (09:47:x and SIP +/-) are the time stamp taken from Exhibit 2 and its difference from the SIP time stamp, respectively. The SIP time stamp is shown in column 2 (Time).

Some interesting points (the first is significant enough to dismiss the conclusions in AW's paper, but there is other value to extract):

|

|

One of the most disturbing realizations from this exercise is that there is no true pricing information for stocks! When brokers and high frequency market makers use their own, un-auditable feeds, there really is no way for anyone to know who is playing by the rules and if investors are provably getting fair prices. Just look at how much effort it took to analyse a few thousandths of a second in one stock. This is why, at the heart of Reg NMS, there is the concept and requirement of a SIP (Security Information Processor, or consolidated feed). In their landmark $5 million dollar fine imposed on the NYSE for providing direct feed subscribers with data before the SIP, the SEC wrote:

When Congress mandated a national market system (“NMS”) for trading securities in 1975, it emphasized that consolidated data “would form the heart of the national market system.” The Commission since has emphasized the importance of the consolidated data feeds on many occasions, including in its January 2010 Market Structure Concept Release: “As a result, the public has ready access to a comprehensive, accurate, and reliable source of information for the prices and volume of any NMS stock at any time during the trading day. This information serves an essential linkage function by helping assure that the public is aware of the best displayed prices for a stock, no matter where they may arise in the national market system.” In addition to providing the view of the market for many investors, consolidated data feeds also play an important role in price discovery and compliance functions. For example, a number of exchanges and other trading centers use the consolidated feeds to check prices at other trading centers to determine whether they may execute an order or whether another trading center has a better price.

And as explained by SEC Enforcement Director Robert Khuzami to the WSJ:

Improper early access to market data, even measured in milliseconds, can in today’s markets be a real and a substantial advantage that disproportionately disadvantages retail and long-term investors.

Rule 603(a) of Regulation NMS:

Rule 603(a)(1) requires that any market information distributed by an exclusive processor, or by a broker or dealer (including ATSs and market makers) that is the exclusive source of the information, be made available to securities information processors on terms that are fair and reasonable. Rule 603(a)(2) requires that any SRO, broker, or dealer that distributes market information must do so on terms that are not unreasonably discriminatory. These requirements prohibit, for example, a market from making its "core data" (i.e., data that it is required to provide to a Network processor) available to vendors on a more timely basis than it makes available the core data to a Network processor.

And finally, we'd like to point out how often the term NBBO (National Best Bid/Offer) is misused by the media and High Frequency Traders (HFT) who talk a lot about how they improve the NBBO. But how would they know, since many of them also claim they never use the SIP (jump to 64 minute mark in this video)! Here is the specific legal definition of the NBBO (a SIP is a plan processor, direct feeds are not):

And finally, an animation we put together showing how direct feeds continue to get an illegal speed advantage - which is what enables the "market is rigged" behavior to exist.

We were able to fill in a few blanks with information from an anonymous writer, and wish to thank them for spending the time and sharing. However, nothing presented here changes the crux of our original paper: the market is systemically rigged. In fact, from the information supplied by AW, the market may be more rigged than previously thought, and as this exercise shows, way too complicated. Certainly too complicated for anyone at the SEC or Congress to understand.